Monetization’s effect on CAC (and IPOs)

Spotify recently announced that it acquired a content recommendations company called MightyTV, and will absorb it into the Spotify product team.

It looks like a move to improve user retention (even more!) by strengthening their content recommendations and discovery.

But, the company also plans to leverage MightyTV’s tech to improve their offering for brand advertisers, making the acquisition a way for Spotify to expand monetization as competition heats up and the company prepares for a 2017 or 2018 IPO.

Monetization is a competitive differentiator

Spotify has the best paid-to-free user ratio in the business with 50 million paying users out of somewhere north of 100 million total registered users and an estimated 30 million MAU.

Despite Spotify’s great lock-in, their competitors are growing.

- Apple Music’s subscription business is growing with 20 million paid subscribers, and an industry-leading estimated 40 million MAU (interestingly, its growth has been largely driven by free trials as opposed to freemium subscription -- but that’s a subject for another newsletter)

- Pandora has just 4 million paid subscribers out of 81 million registered users

- SoundCloud hasn’t disclosed its paid subscriber count, but the company has 40 million registered users out of 175 million monthly unique listeners

YouTube mobile, Amazon Music, and Google Play are still small, but significant enough to cause a thorn in Spotify’s side when it comes to competing on increasingly expensive acquisition channels.

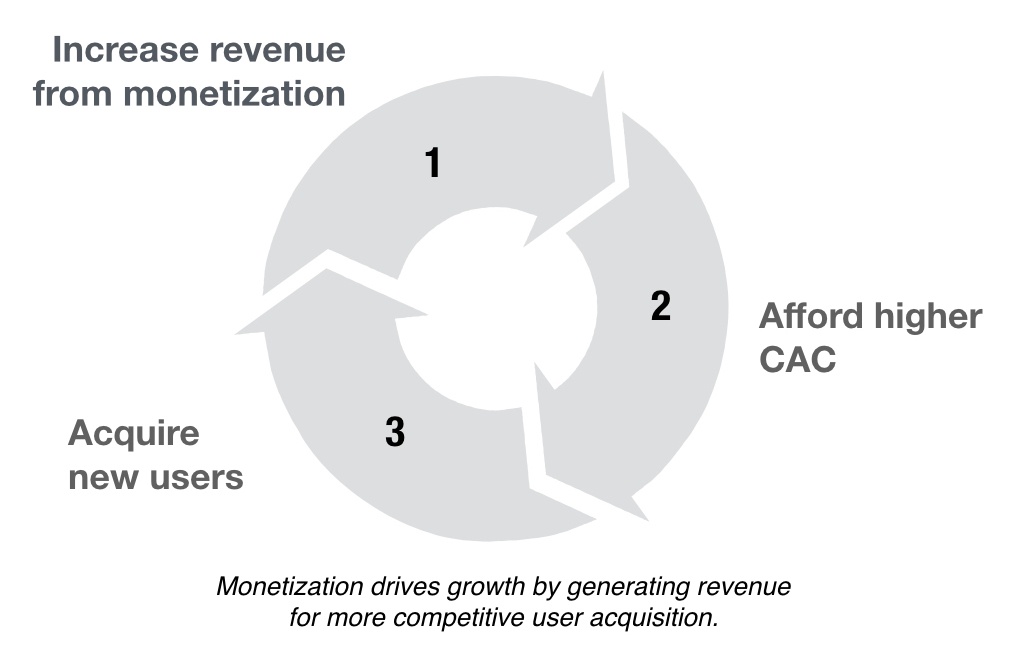

As competition increases, and acquisition channels enter the mature stage approaching saturation (recall the Reforge lecture on the lifecycle of channels), monetization becomes critically important to maintain a competitive advantage because it affords companies a higher CAC.

Monetization, or a path to profitability, is also important in today’s current financial climate as Spotify considers an IPO within the next year / year and a half.

Expanding monetization beyond subscriptions

Spotify currently monetizes in two ways:

1. A freemium-driven paid subscription

2. Ads on its free tier

Streaming is a $3B market worldwide and represents 19% of the global music market, including digital sales and physical sales.

But, current licensing agreements don’t leave room for great margins, and so doubling down on monetization on both subscriptions and ads would not only help the company improve financials before a public offering, it would also potentially increase Spotify’s leverage with music labels.

How does a content recommendations engine serve all of this?

Spotify’s VP of product, Jason Richman, drew the connection between MightyTV’s recommendations systems and Spotify’s own advertising and marketing personalization technology:

“[MightyTV founder] Brian and his team will help us continue to innovate on free monetization and extend our leadership position in programmatic audio.”

So, while Apple Music may be growing user counts with its free trial model, Spotify is finding a way to make its freemium tier do double duty -- as a subscription driver and an ad platform.