Thoughts on Growth — Feb 23, 2018

Thoughts on Growth is Reforge's weekly newsletter of must-known updates and perspectives in growth. By subscribing, you'll join a few thousand PMs, marketers, UX folks, engineers and analysts at today's top tech companies. Check out a recent sample below.

1. The data behind discounting

WHY IT MATTERS

Most of us get that discounts aren't great (if you've been through Reforge Growth Series, you'll recall that price acts as a psychological signal for many types of products, from Gucci bags to subscription SaaS).

But, while proven tactics to juice top of funnel can be hard to resist, especially for a quota-driven sales team, you should try :) — especially in subscription SaaS.

3 reasons from a recent study of SaaS companies:

Discount-acquired customers were less likely to renew because they came in with lower willingness to pay and were more likely to bounce out when a renewal came around.

Easy come, easy churn. Any change in pricing — including if they level up usage to a different tier, or it's time to renew at the regular price — is more likely to trigger churn and comparison shopping for price sensitive discount cohorts.

LTV (and any WoM you might've gotten) decreases. When you discount, you're essentially raising your CAC, and increasing the amount of time you need to make back the investment. But, since discount-acquired customers are more prone to churn, you might never hit that ROI milestone.

LEADER OPINION

Nice theories, but in reality, most of us are going to dabble with discounts. To help us out, Patrick Campbell has a few recommendations:

“Be discrete. Don't broadcast to everyone that you're offering the same product at a lower price.

Segment discounts. Only target those who need the extra push to close the deal, and don't offer to those who are willing to pay the full price.

Limit in scope and time. The point of a discount is to lower the initial activation energy needed for someone to close, but then your product should convince them that the full price is worth it.

Finally, vary your offers so that customers don't learn to expect, and wait for, a discount rather than paying full price now.

If you do decide to offer a discount, you can maximize your initial returns by offering the discount on your annual plan (or other highest price / highest lock-in offering).”

Wait! What about discounting in consumer or in marketplaces?

Uber is famous for using price incentives to increase demand or supply, so I pinged Andrew Chen for some thoughts.

“Marketplace discounting is interesting. Discounting the demand side leads to discount shoppers. Lower LTV, lower $ transactions, etc. Not what you want.

However, it's the opposite on the supply side. Incentivizing the supply side leads to more $-motivated users, who work harder for the money. Higher productivity, more hours put in, etc.

They're two sides of the same coin but each side of a marketplace acts in the opposite way!”

READ MORE

2. Instead, monetize in the direction of value

WHY IT MATTERS

Discounts are risky, but Andrew makes a great point above about monetary incentives driving behavior.

This is super important, because how you price, and where you put the paywall, can also suppress desired behaviors from your users.

Don't put it somewhere where it's going to interfere with deepening engagement / habit creation, or with virality, says Casey Winters (EIR @ Greylock, former Growth @ Pinterest).

Sounds obvious, but plenty of companies aren't following:

Mixpanel charges per event, but user engagement with their product deepens if they track more events. Users are forced to face the cognitive friction of, “Do I really need to track this particular event?” which disincentives deeper engagement.

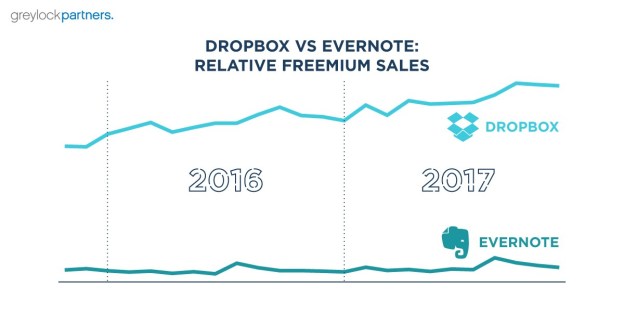

Evernote allows unlimited note creation for free, but paywalls collaboration opportunities, thus diminishing virality.

In both of those examples, the monetization model dis-incentivizes the user from actions that contribute to long term growth.

LEADER OPINION

Few people would disagree with the point that monetization needs to align to value created. Surely the Evernote folks thought that that's what they were doing by putting the paywall in front of multiple devices and storage size (monetizing their “super users” — makes sense, right?).

The root challenge is actually pinpointing value, and this is true for non-subscription businesses as well.

How do you identify where the most valuable value lives? I pinged Casey Winters to get his followup thoughts:

“It's all about key actions. Many products have multiple ways to create value. You want to identify which one correlates to long term retention, then test pushing people to do that thing to see if the relationship with retention is causal.

What Evernote's mistake was is that they blocked elements that help create super users, who would then be easier to monetize.”

READ MORE

Align revenue to the value you create (the original must-read post from Casey, with expansion on the takeaways above)

Why onboarding is the most crucial part of your growth strategy (more of Casey's thoughts on key actions, and the relationship between monetization and onboarding)

3. How Duolingo aligns its growth vectors to hit a $700M valuation

WHY IT MATTERS

Early Duolingo had two faces:

On the consumer side, it was a free language learning app that made the process fun and game-like by having users learn a language by translating things on the web.

On the flip side, it was a B2B tool to crowdsource translations from language learners.

The B2B side of its model bankrolled investments in consumer side growth (translation services were a $43B market in 2017).

But, selling a crowdsourced translation tool to other companies is a pretty different business from creating a high-engagement consumer app, and eventually, Duolingo shut down its translation business and restarted app monetization from scratch (first ads, then premium subscription and in-app purchases).

When you're growing your product in a competitive space, and you're working hard to maximize all your levers, you can't afford not to align all of them in the same direction.

Once it threw all of its weight behind growing the consumer app, Duolingo was able to rapidly accelerate new users and increase the percentage who stayed on as engaged monthly actives — eventually capturing top tier investor interest and locking in a $700M valuation.

LEADER OPINION

Brian Balfour, founder / CEO @ Reforge, shares a framework for thinking through where and how to monetize:

“Hubspot's CEO Dharmesh Shah learned a unique insight from Elon Musk that he evangelized throughout the whole company:

'Every person in your company is a vector. Your progress is determined by the sum of all vectors.'

The same thing can be applied to growth:

Every piece of your growth strategy is a vector — and that includes growth vectors like acquisition, engagement, and monetization. Your overall growth is the sum of all vectors.”

READ MORE

What Elon Musk taught me about growing a business (Dharmesh's great writeup on his convo with Musk)

How Duolingo built a $700 million company without charging users

4. Google launches Auto Ads for AdSense -- what it means for paid marketers

WHY IT MATTERS

Software is eating the world, and that applies to growth as much as it does to manufacturing or anything else.

This week, Google launched AdSense “Auto Ads” to automatically determine what ads should be served on a given page, where to place them, and how many to show.

For publishers running AdSense, this is means simplified execution of ad-based monetization strategies, and could mean better results as they hand over more of the reins to Google (more data, better optimizations).

But what does it mean for paid marketers?

LEADER OPINION

We pinged Andrew Silard, VP Growth @ Grove Collaborative and former VP / GM at QuinStreet (paid marketing superpower), for his thoughts.

How meaningful is the Auto Ads rollout?

It's meaningful for publishers and for ad networks near term, but less meaningful for advertisers. Publishers now can 'trust Google' to maximize not only ad fill-rates but also ad placement. This could lead to stronger eCPMs and revenue for publishers.

For advertisers, maybe this leads to better campaign performance in the near term but more likely this eventually leads to even further spend consolidation with Google over the longer run.

Given the dominance of social ads, plus the proliferation of expanded options on Quora, Pinterest, IG, LinkedIn etc, is AdWords still relevant to a 'modern' paid strategy?

Remember product-channel fit. You should focus your growth efforts on the channels that are best suited for your product and business model before testing newer/other channels where that fit is less clear.

If your product/model can serve people that are using a wide variety of existing search terms, then Adwords will likely be one of your best channels and you should invest heavily in being world-class at it. Ecommerce (lots of products) & marketplaces/aggregators (lots of locations, services, categories: think Etsy, Ebay, Thumbtack) are two classic examples of highly Adwords-driven models. Well-targeted search ads can also overcome lack of brand awareness and help newer companies break through. That's much harder for younger brands to do on Facebook.

That said, Adwords is a harder channel to manage and scale than many others. You can easily have hundreds or thousands (!!) of campaigns with individual bids and budgets to manage. So, if you think you can get great growth elsewhere more easily or more cheaply, it's worth experimenting to find out.

Do you think this move towards automation is the "beginning of the end" for paid marketers?

No, but the shift towards more machine learning and automation in paid marketing is definitely changing what it means to be a great paid marketer.

Some skills are becoming more important:

Understanding how to create (and scale) great creative

Figuring out how to stand out from the other ads in the feed/on the page

These will be the differentiating factors in campaign performance.

Another major shift is towards optimizing the entire conversion funnel, including downstream funnels like email, retargeting, referrals, etc., which can all influence your paid channel performance (i.e., increase your buying power) with the right analytics and common-sense attribution.

READ MORE

Get Thoughts on Growth

Thoughts on Growth is Reforge's weekly newsletter with must-know updates and news in growth, along with growth leader opinions to give you more context.