Thoughts on Growth is Reforge's weekly newsletter of must-known updates and perspectives in growth. By subscribing, you'll join a few thousand PMs, marketers, UX folks, engineers and analysts at today's top tech companies. Check out a recent sample below.

1. Two ways to crowdsource data to feed growth

WHY IT MATTERS

When it works, crowdsourcing data can feed massive growth. See: Yelp (reviews), Wikipedia (entries), or Genius (lyrics annotations).

But when it doesn't work, either because of a failure to create a network effect with that data or because users simply aren't motivated to give you the data, products can look sparse and empty. Without users fleshing out the product, it's just a skeleton. See: every failed social network ever.

Spotify has been successfully leveraging user activity data into popular playlists for years. But with Line-In, a new tool they announced this week, Spotify will be explicitly asking users for meta-data, like classifying artists and tracks by genre or mood.

With its massive existing data sourcing machine, why does a feature like Line-In make sense for Spotify now?

LEADER OPINION

We pinged Mike Duboe head of growth @ Stitch Fix, where they recently rolled out something similar. Stitch Fix is an org that thinks of itself as a personalization company first and foremost, and has the 90-person data science team to back it up.

How do you think about sourcing — and using — data for growth?

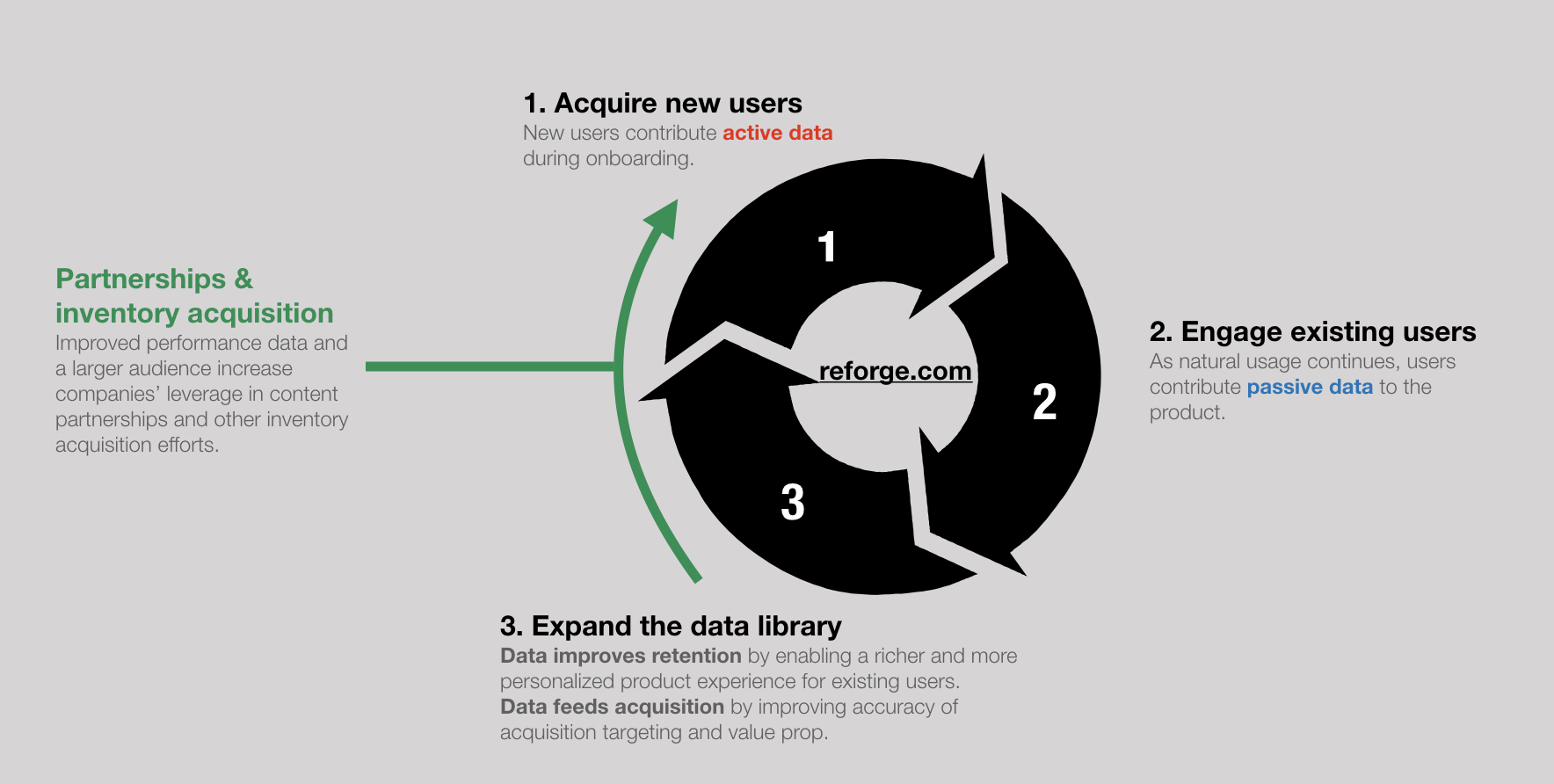

“There are two key types of data you can collect for growth:

1. Passive data generated from usage of the product.

With passive data, we're analyzing user behavior that is inherently part of using the product. Data is gathered in the background.

Passive data is much more powerful because it's baked into the use of the product, similar to how viral loops require an inherent social use.

2. Active data, which is where the user is explicitly giving it to you.

Collecting active data, on the other hand, always has to be framed in context of the core value prop of the product.

To get active data, you need to ask your user to consciously provide feedback (structured or unstructured) back to the service.

For Stitch Fix, our core product is one of Personalization, so deeply understanding our clients is critical.

Passive data collection includes:

- items clients keep/return

- geography (i.e. can personalize fixes by weather)

- initial intent at time of acquisition, etc

Active data collection includes:

- upfront style profile

- feedback on specific items (e.g. on size, price, style, fit)

- qualitative feedback sent to stylists, etc

Stitch Fix is famous for doing great passive data collection, yet you recently added a Tinder-like thing where people can thumbs-up or thumbs-down items. If you were getting pretty much everything you needed from the passive data -- why put this extra ask in front of users?

“Yes, our app now includes an experience to collect more bite sized pieces of data that help us understand client preferences -- and also engage clients.

While our upfront style profile and ongoing feedback from fixes does provide substantial data to improve personalization over time, this feature is a way to surface a broader array of items to clients and expand the volume of feedback we collect -- while also simply being good for engagement.

The core use of this data is to improve our ability to match clients with clothes they'll love -- which thus leads to retention. However, this data can also be used to inform upper-funnel targeting, on-site personalization, etc.”

We recently added more active data into the mix by rolling out a Tinder-like UI where people can thumbs up or down items in the dashboard.”

READ MORE

- The secret hit-making power of the Spotify playlist (How Spotify relentlessly tests tracks)

- Is Genius smarter than past attempts to annotate the web? (On Genius' ambitious efforts to harness crowd-sourcing)

- How Personalization Drives Retention and Monetization for Stitch Fix

2. “Growth” is a complex story. Here's how to tell it right.

Image from First Round Review

WHY IT MATTERS

If you can't express complex concepts then you can't share nuanced customer insights with your team, explain the value of your initiatives to your company, or communicate the value of your product to your user.

Over and over again we're all tasked with presenting complicated ideas in a way that our audience understands and finds compelling.

It's a problem Tim Urban understands better than most. Urban is both a blogger at "Wait Buy Why," where he explains complex concepts to an audience of a million readers a month, and the co-founder and Executive Director of ArborBridge, a test prep and educational services company.

In a recent interview with First Round Review, Urban explains 3 types of complexity and how to communicate complex concepts in ways that stick (see image above).

LEADER OPINION

We checked in with Shaun Young, editor at First Round Capital and author of the interview with Tim Urban, who offered a perspective on how to apply the 'Tim Urban method' to anything from content creation, to customer insights research.

“The distinction between 'effort making sense of the idea' and 'effort presenting the idea' really resonated with me.

To make sure stories we are telling have a tactical and applicable element, making sense of an idea comes down to answering the question: can someone else beside the subject execute this advice right away? If we can get to a “yes” quickly, it becomes easier for us to present the idea.

Here's one way that we do it, that can apply to any scenario where you're trying to distill personal experience or complex knowledge for practical use:

1. Ask a direct question about a practice or belief. (The first answer is usually really broad.)

2. Ask it again differently. (The second answer is always more detailed.)

3. Ask: how do you do that? Probe for a process or list of steps.

4. Ask: Can you share an example of what you just said in practice? As a story or anecdote?

You'll see it's mostly diligent repetition — but that's often what it takes to cut through to the tactic we can use or share.”

READ MORE

- Wait But Why's Tim Urban on parsing and transmitting complex ideas (the article from FRR)

- Six Tools for Communicating Complex Ideas (how leaders can make information stick)

- How to create an authentic brand story that actually improves trust (telling brand stories)

3. The more integrations, the higher the retention?

WHY IT MATTERS

Understanding how integration impacts retention is about understanding how products return value to their users.

If you're building a product, you need to appreciate how the right integrations with the right products make it even more valuable to your users.

But also, as we are all users of multiple different business tools, it's important that we understand that the more we invest in integrating our tools, the more value we can unlock.

LEADER OPINION

Patrick Campbell, Co-Founder & CEO at Price Intelligently, shares:

“Integrations used to be a luxury. The simple software we used was the bread and water of functionality, so bringing multiple applications together felt like an indulgence we just couldn’t afford.

Yet, with the explosion of software, bringing together all of the different tools we use to act as a coordinated unit isn’t just table stakes, it’s a necessity....or so the data shows us.

Customers with even one integration appear to have 10% or more better retention on an absolute basis than those with no integrations within your product.

Further, as integrations increase to 4 or more, retention appears to increase by an additional 3-7 percent on an absolute basis.”

READ MORE

- The full report on Integration Benchmarks (a look at change in retention by # of integrations)

- Do Apps That Integrate With Zapier Have Lower Churn?

4. Is it time to sunset your product / feature?

WHY IT MATTERS

Twitter recently announced that they would be sunsetting their Twitter for Mac app. For many Twitter users, that doesn't mean much, but to a small group of users, it drastically changes the way they'll use Twitter.

Sunsetting a product or feature is always a difficult decision for a company to make, and a sensitive process to execute.

But like a controlled burn in a forest, cutting back in one part of a product's surface area can sometimes be the only way to open up resources for new growth.

LEADER OPINION

We reached out to Nihar Bhupalam, Group Product Manager @ Mixpanel for his take on when to sunset a product or a feature:

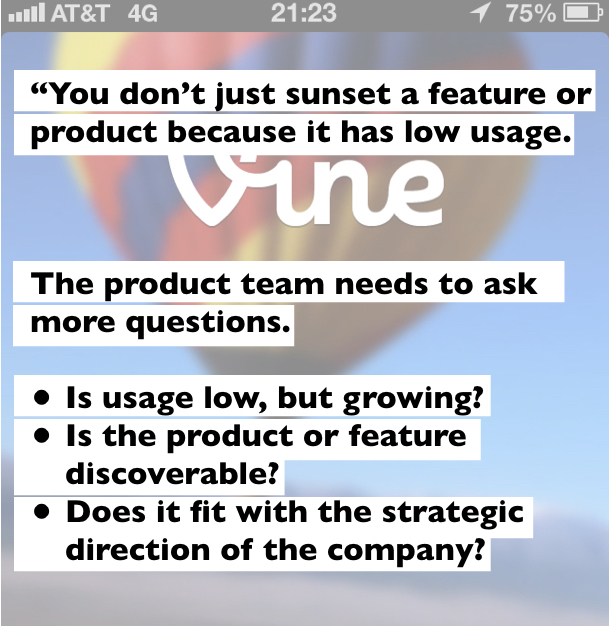

“Of course you need to stay on top of usage metrics, but you don’t just sunset a feature or product because it has low usage.

The product team needs to ask more questions:

- Is usage low but growing?

- Is the product or feature discoverable?

- Does it fit with the strategic direction of the company?

Last year we made the decision to shutdown Mixpanel Surveys. There were many factors, including how much the survey space had grown and matured since we first launched it.

But, the biggest factor was that Surveys wasn’t core to our goal of helping the world learn from its data. We knew that we could better reach that goal and make our customers happy by making investments in other areas of the product.

It's bittersweet, but thoughtful communication and ample time for users to change over helps the transition go more smoothly."

(This reminds us of a recent Thoughts on Growth Snippet on how Duolingo is applying an Elon Musk lesson to align growth vectors.)

READ MORE

- How we sunset features (Luno walks through how they sunset a feature)

- Google Reader lived on borrowed time (reflections on the shutdown of Google Reader from its creator)

GET THOUGHTS ON GROWTH

Thoughts on Growth is Reforge's weekly newsletter of must-known updates and perspectives in growth. By subscribing, you'll join a few thousand PMs, marketers, UX folks, engineers and analysts at today's top tech companies. Check out a recent sample below.