Thoughts on Growth is Reforge's weekly newsletter of must-known updates and perspectives in growth. By subscribing, you'll join a few thousand PMs, marketers, UX folks, engineers and analysts at today's top tech companies. Check out today's edition below.

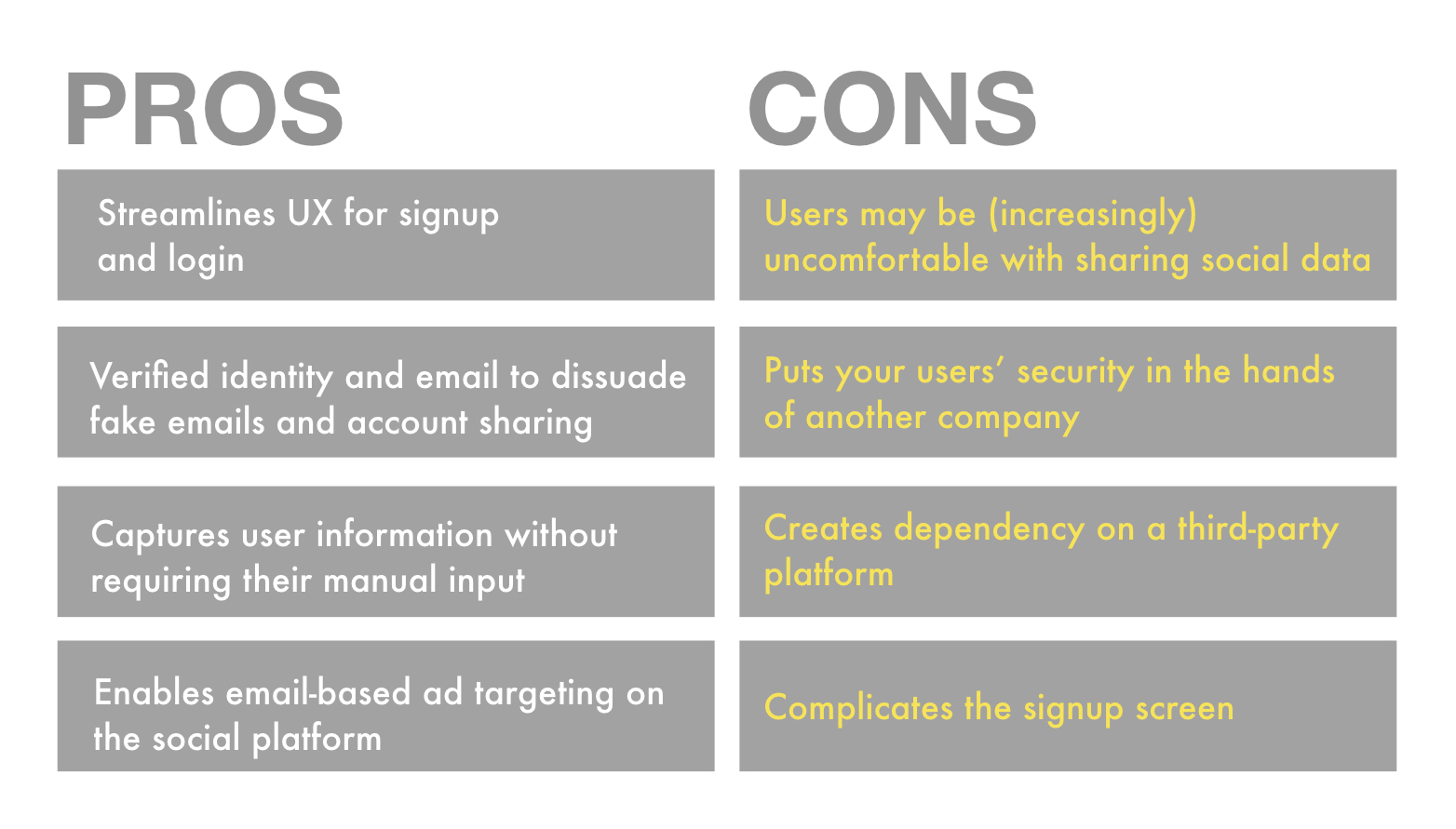

1. Social login's pros and cons in the age of data sensitivity

WHY IT MATTERS

“Friction is the enemy.” That was the a driving force behind adopting social login. Why make users to type out their email and create another password they'll have to manage? In just a couple taps they can create an account using their Facebook, Twitter, or Google account.

And the numbers appeared to have backed it up. Back in a 2014, people reported they used social login 51% of the time they encountered it.

But even then, the most popular reason for people not using social login was not trusting a company to use the information appropriately. In light of recent data abuses, many users are reevaluating how they use social platforms, and that means products need to take a look at the potential downsides of social login.

Many products have used social login to collect data from their users to put to use in the product or marketing. But in response to the Cambridge Analytica fiasco, Facebook has announced it will begin limiting the data that it will share.

While this may work to make social login more trustworthy for users, it also makes it less appealing for growth

LEADER OPINION

BINDU REDDY, Deep Learning @ Amazon and former CEO and co-founder @ Post Intelligence (acquired by Uber) wondered:

“The Facebook drama around Cambridge Analytica might put Facebook connect under a lot of scrutiny... Making it much harder for apps to use FB connect/sign-in anymore.”

BUFORD TAYLOR, Head of Engineering @ Reforge and formerly @ Eventbrite:

had some thoughts on this, since we're using social login for our program portal for the Growth Series and the Retention Series:

As a user, security is definitely an issue. When I give access to my contact list, I don’t know how deep the rabbit hole goes. Some companies do auth wrong and require third-party active sessions at all time (even some pretty big companies!).

Keep in mind that the technical process of third-party auth is this:

1. Click third party auth button

2. Third party replies via an API

3. You record the user’s email and the third-party unique identifier in your database, and you create your own local session not using the third-party.

Dependency on a third party platform is pretty easily fixed. You’ve already got their login email from the third party, now you just need to create a password for them. When the user signs up, just prompt for a password, and BOOM now they have the choice to log in via Facebook or via email.

However, third party login does complicate sign up. Not only do you have to support oauth, if you’re doing stuff ON the third party platform, like upvoting stuff, auto-replying, etc, the third party typically requires you to have a refresh token from time to time — so, more steps to handle.

READ MORE

2. Instagram expands “Shop Now” with product tagging, streamlining social selling

WHY IT MATTERS

Instagram announced it will be allowing more businesses to tag products their posts. This allows users to tap the tag to see more details from the products in the post, and tap through to the business website to purchase the product. The feature was first tested in the US last year.

Product tagging will begin rolling out to businesses across the globe, and we don't know who those are yet, but no doubt it will grab the attention of brands up and down the food chain who are already leveraging Instagram's in-app shopping and targeting features.

It will be interesting to see the impact this has in the on-going Instagram battle between brands and products.

While many bigger companies are using the platform as another brand marketing channel to build a relationship with their customers, niche products are leveraging Instagram's direct response capabilities to make immediate sales with micro-targeted sponsored posts.

With less emphasis on brand for many of these products, it can often mean the quality of the product isn't as important as the means to move it.

LEADER OPINION

MEGAN QUINN, General Partner at Spark Capital and formerly Head of Product @ Square, wondered if this could be game-changer:

“Instagram ad targeting + their newish integrated “Shop Now” feature + ApplePay/AmazonPay is the holy grail of online shopping. Helpful curation, delightful browsing, insanely fast checkout without forms or inputs — and dangerous on the pocketbook.”

Could Instagram be another tool in the attack on bigger brands by the long-tail of “micro brands?”

SCOTT BELSKY, Chief Product Officer @ Adobe and founder of Behance:

“In just ten minutes or so scrolling on Instagram, I counted over a dozen brands I had never heard of selling a product that caught my eye. There are so many direct-to-consumer brands we’ve never heard of these days, and I’ve patronized more than I care to admit.

For the past decade we’ve invested in and celebrated companies through the lens of network effects, Amazon’s power in retail, and measuring the potential of a brand by its scale and path to category dominance. We assumed that antiquated monolithic brands would be attacked by new modern brands that take over consumer consciousness en masse.

But instead, old and big brands are fighting against thousands of tiny brands with low overhead, high on design merchandise, and supremely efficient customer acquisition tactics. Many of us failed to recognize the collective impact of the long-tail of micro brands.

Using hyper-targeted marketing, just-in-time manufacturing, and social media, these brands find and engage their audience wherever they may be.

Of course, small brands are nothing new, but they typically remained small companies. Now I’m hearing about more and more of these brands with tiny teams generating over $10M in sales, with higher-than-normal-retail profit margins.”

READ MORE

3. Even network effects have diminishing returns. Here's how to keep getting value.

WHY IT MATTERS

Growth product teams may dream of a cycle where the strength of their network of users drives more product quality, resulting in more users and endless growth.

But in reality, even the strongest network effects will, at some point, start delivering diminishing returns as the network grows, and eventually level off.

By introducing new services, companies can get more from their existing network effect — even if the curve has flattened — and either lower costs further or increase market penetration

LEADER OPINION

I spoke with Suhail Doshi, CEO & Co-founder @ Mixpanel, and asked him to share some thoughts on how new technologies can revitalize network value.

SUHAIL DOSHI, CEO & Co-founder @ Mixpanel:

New technology is more expensive at first because version one is rarely optimized for price. Generally you're optimized for achieving a use-case. It becomes a lot cheaper and better over time because the major cost optimizations come after the company has proven product market fit.

But that's not always interrelated with demand. Demand isn't always going to drive costs lower and create more demand. It may simply fuel the ability to hire people to focus on the problem, to optimize cost and drive market penetration.

Look at Uber. It started as a black car service, but found demand through UberX. Only then, once it had product-market and demand-created network effects, was Uber able to further lower cost and increase their market penetration with the addition of UberPool. Products like UberPool are dependent on a marketplace, and only possible by leveraging network effects.

Now apply that to a new technology like AI. It makes new use cases possible, but it AI will increase cost at first. The reason is the same as above: first you nail down use-case to achieve product market fit, and only then can you optimize use-case to become more computationally efficient.

But then there are some cases, like recommendation engines, where you can utilize machine learning to improve conversion rate and offset costs through increased revenue. But, again, those additional use cases to drive market penetration require having data and are just not possible without first creating a network effect

READ MORE

- Understanding Network Effect Strength (great, brief writeup that inspired this snippet, from Josh Breinlinger, VC @ Jackson Square Ventures and co-founder @ Rev)

- The network effect means Uber is always likely to win in London

- The Power of Data Network Effects

4. LinkedIn launches autoplay video ads + native video for company pages. Here's who should try it.

WHY IT MATTERS

Recent tests showed LinkedIn members spent 3X more time watching autoplay video ads, and now LinkedIn is launching the feature for company pages and promoted posts.

But will those results persuade B2B companies to invest in video on LinkedIn?

By the nature of the auto-playing video, users are going to watch see more. But, in most cases, knowing that your audience will see more of your video isn't enough by itself. Autoplay ads will have to show improvements further down the funnel to prove that they actually translate into a better campaign.

LEADER OPINION

SAM WHEATLEY, Director of Growth Marketing @ Noom:

If you've already tested the channel and it worked, I'd be optimistic about video improving your top of funnel costs.

If you tested LinkedIn and it failed, I wouldn't prioritize retesting it based solely on a new ad type.

Realistically, companies should already have some form of video-based creative — but that doesn't necessarily mean professionally produced, 2+ minute assets. A 5-10 second GIF as simple as a still image + text overlay can honestly be all you need.

With that low-cost option as the asset, the negative impact of a low-ROI test result should be small (assuming you have some familiarity/experience with the channel already and don't have to deal with a learning curve).

If you need any help creating video assets, Facebook has been investing a lot of resources into developing creative partners. Many of the partners focus on making video production and iteration a scalable process. Here's their list.

Should that concern companies looking to use video ads on LinkedIn?

Considering how effective video ads currently are on Facebook/Instagram, I would be more optimistic than concerned about video ad performance on LinkedIn.

Plus, as long as you can keep the time/resources you put into video production cheap, then testing to verify ROI shouldn't be too expensive. It's also good to bear in mind that video wasn't effective when first rolled out on Facebook/Instagram. It has taken time for it to mature and start working well for DR campaigns - the same may be true for LinkedIn.

For certain verticals or objectives, LinkedIn could prove to be an exception to the engagement vs. ROI issue.

Specifically, the demographic (particularly job) targeting on LinkedIn is so accurate and effective for B2B Lead Gen (and some B2C objectives) that increased engagement may translate actually into improved ROI, as well (i.e. depending on objective, incremental engagement from an LI user could be more valuable than incremental engagement from an FB/IG). That's an optimistic hypothesis, but one I'd certainly argue worth testing in certain verticals.

By the nature of the product auto-playing, users are (obviously) going to end up watching more of the video. So is this "3X" stat compelling enough on its own to mean a company *must* invest in video ads?

Regardless of LinkedIn's 3X stat, companies should already be investing in video ads. With that said, the "3X" stat seems unlikely to hold up -- especially at scale.

But even if it’s only half of what LinkedIn is reporting, I would be very happy with a 1.5x improvement to the top of my funnel. If video is worse than other creative types, I would assume that you'll be able to retarget video viewers in the not too distant future, which could lead to an overall more efficient campaign in time (video-view retargeting can be super-effective on Facebook).

Again referencing the strength of LinkedIn's targeting -- you can pack a lot more information into a video ad than a still image. Conveying more information more efficiently to LinkedIn users is appealing.

What are the next steps/metrics in that funnel so that you can make sure that this autoplay ads are actually translating into a better campaign?

Considering how cheap it can be to test creative in paid social channels, I think it’s worth investing enough to use a step/metric you can have a high degree of confidence in. So for eComm/Subscription eComm, purchase. For LeadGen, lead, etc. If you can't afford that, I would use the first step of your funnel where a user shows positive signs of intent (email submission, add to cart, etc).

How should companies/products approach more eye-catching content to walk that line of not being boring, but also not being overwhelming?

Walking that line is definitely difficult. Of course, ideally, you're able to find new and diverse creative on a regular basis! More realistically, as you're trying to find new approaches, small tweaks to existing assets like new overlay text or same text with new background video/image, etc can go a long way. But ultimately, your performance data will be your best guide to when you're starting to cross the line and how urgent a refresh is.

READ MORE

GET THOUGHTS ON GROWTH

Thoughts on Growth is Reforge's weekly newsletter of must-known updates and perspectives in growth. By subscribing, you'll join a few thousand PMs, marketers, UX folks, engineers and analysts at today's top tech companies. Check out today's edition below.