Bangaly Kaba

EIR at Reforge, Former VP Product Growth at Instacart, Head of Growth at Instagram

Fareed Mosavat

GP at Reforge, Former Dir Product Growth at Slack, Instacart, Zynga

Anne Lewandowski

OIR at Reforge, Former Product Lead, Growth at Apartment List

With contributions by Elena Verna (EIR at Reforge, Growth Advisor at Miro, Netlify, MongoDB), Ravi Mehta (EIR at Reforge, Ex-CPO at Tinder), and Adam Grenier (EIR at Reforge, Ex-Head of Growth Marketing at Uber)

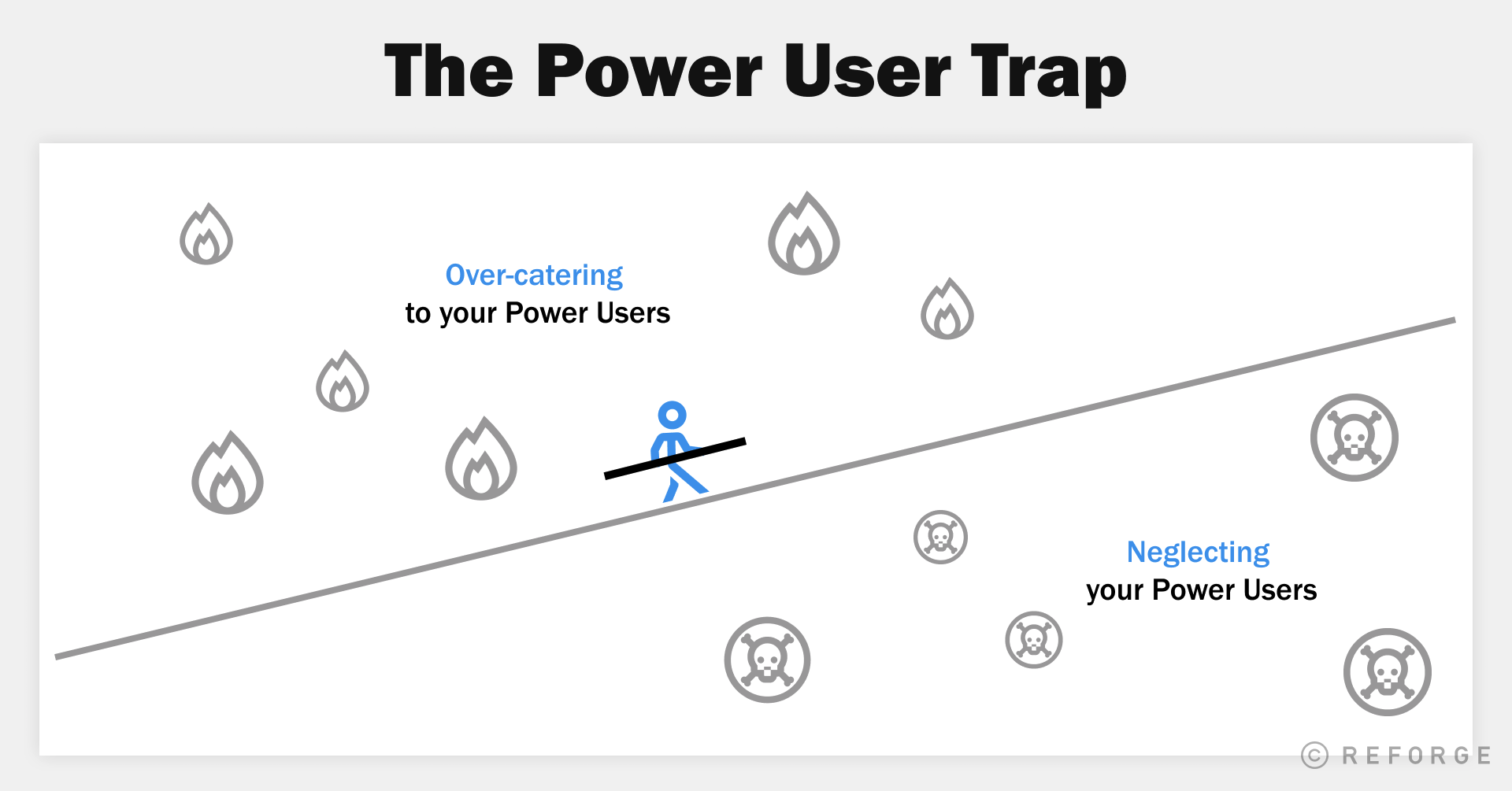

Most companies have an overly simplistic view of their Power Users, defining them as the most frequent users on their product. Knowing when, how, and what to build for them is tricky. Teams either over-optimize for them or neglect them, ultimately killing their products: this is The Power User Trap. Product leaders end up in this trap because Power Users aren't necessarily the most frequent users of your product, but rather those that are outliers in influence and behavior within your product ecosystem. Having a more clear definition of who Power Users are, what specific impact they have on your ecosystem, and how they change over time is what lets you avoid The Power User Trap. In this piece, we'll discuss:

What The Power User Trap is

What leads to The Power User Trap

How to avoid The Power User Trap

The many different types of Power Users

The Power User Trap

Product leaders walk a tightrope when deciding how to prioritize their Power Users' needs against a broader audience's.

Falling off one side of the tightrope results in Failure Mode 1: over-catering to your Power Users at the expense of your product ecosystem as a whole.

Alternately, you can fall off the other side of the tightrope into Failure Mode 2: neglecting your Power Users and alienating the people who generate significant value for your product.

This is The Power User Trap. While the failure modes look different, falling off either side of the tightrope takes you to the same place: a dying product with a declining user base.

Failure Mode 1: Over-optimizing for Power Users

This failure mode is when you spend too much product effort building specifically for your Power Users at the expense of the broader audience. This manifests in a few ways:

Over-complicating the product, leading to stagnant new user growth and engagement: Product changes targeted at Power Users can make the product difficult, expensive, or too complex for new and non-Power Users.

Example: Adobe Photoshop added features targeted toward professionals, increasing the product's price and complexity. This has driven casual and price-sensitive users to lighter-weight tools like Canva.

Poisoning the ecosystem: If Power Users dominate the product in a way that worsens the experience for others, the broader audience will leave, potentially setting off a death spiral. Marketplaces and social networks are at particularly high risk of this outcome.

Example: LinkedIn risks falling into this trap as it offers more products targeted at sales and recruiting Power Users. As users' inboxes become cluttered with unwanted sales and recruiting outreach, high-quality messages get lost in the noise. This crowding-out leads to a less valuable experience for LinkedIn members, making them more likely to disengage, and ultimately making the product worse for all users.

Missed Product Market Fit (PMF) Expansion opportunities: The more resources you dedicate toward your Power Users, the less you have to pursue new Product Market Fit Expansion opportunities. You risk missing opportunities to serve Adjacent Users, ceding ground to competitors.

Example: Uber decided to pursue PMF expansion by building out UberX instead of deepening its investment in premium segments. If Uber had prioritized Uber Black instead, they may have never achieved the explosive growth that ultimately allowed them to surpass the competition.

Failure Mode 2: Neglecting Your Power Users

Unfortunately, many products avoid the over-optimizing side of the Power User trap by plunging off the other side: neglecting your Power Users. This failure mode appears in a few common ways:

Missed low-hanging fruit: Since Power Users are generally a small share of the user base, companies frequently overlook them. Unfortunately, this results in missing high-ROI opportunities to achieve revenue wins or unlock larger product improvements.

"At Tinder we initially missed opportunities to better serve and earn more revenue from our Power Users. We had a segment of the app's audience that had high intent, high willingness-to-pay. Some of these Power Users were being inaccurately flagged for suspicious activity due to high levels of activity and spend. Today, Tinder is better able to identify and support these Power Users, and has rolled out products, such as Tinder Platinum, which better cater to their needs." - Ravi Mehta, EIR at Reforge, Former CPO at Tinder

Gradual decline of the Power User experience: Attempts to make a product broadly accessible can degrade the elements that deliver value for Power Users, eventually driving them to seek alternatives.

Example: Dropbox, in order to streamline its core offerings, sunset its Carousel photo sharing feature. Power Users of that feature not only moved to Google Photos as a substitute, but some also began using Google Drive for tasks they previously did on Dropbox.

Why Do People Fall into the Power User Trap?

In hindsight, many examples of falling into the Power User trap seem obvious and avoidable. However, people fall into the trap for a few common reasons:

Relying on the most common Power User definition

Thinking there is only one type of Power User

Ignoring second-order effects

Being led astray by typical "growth math"

Mistake #1: Relying on the Most Common Power User Definition

The most common way to define Power Users is by looking at a histogram of usage over a given time period (often 28 or 30 days); this is called the L28 (or L30) curve or the Power User Curve. The users in the top histogram bucket are the Power Users.

While this can be the correct way to identify Power Users for some products, in many cases it is either: 1) too broad to be meaningful, or 2) too focused on usage frequency, so it omits important Power User types.

For example, Reforge GP Fareed Mosavat found the L28 definition to be too broad for Slack, where many users had near-daily engagement but were not actually outliers. Instead, Slack needed to apply additional dimensions to identify their Power Users (e.g., how frequently did these users take specific actions like channel creation).

"As you go into those 28-day users, there's a whole other histogram of usage and engagement that comes out that highlights different sub-groups of users. We ended up defining a metric we called 'user sophistication' that included not just activity, but the core behaviors we believed were important to working successfully in Slack, supported by qualitative and quantitative research. We took all of these features, identified if a user was an active user of those features in Slack, and then ranked users based on the number of core features they used. This provided us a sense of of engagement, surface area, and competence." —Reforge GP Fareed Mosavat, Ex-Slack, Instacart, Zynga

Mistake #2: Stopping at One Power User

It is common for people to think their product only has one type of Power User; however, many products have to balance multiple Power Users' needs in order to be successful. While only one persona may directly impact monetization, other Power User types may play a key role in generating Product-Market Fit for a broader audience.

For example, Tinder must keep two distinct groups of Power Users happy. The obvious Power User is the highly monetized user who is an outlier in terms of engagement and spend. While this user directly impacts revenue, a second Power User type is essential for fueling Tinder's growth loops: users who are outliers in terms of receiving right swipes. These users ultimately increase the appeal of the platform as a whole, continuing to draw new users and increasing the value of Tinder's paid offerings. Without them, fewer users would join and stay on the platform, and the experience would ultimately become worse for the high-spending Power Users.

"Lazy Power User thinking looks like only having one Power User persona, and it's you. Lazy Power User thinkers don't do the work to understand how the Power Users contribute to the ecosystem, and they don't do the work to surface multiple types of Power Users."— Bangaly Kaba, EIR at Reforge, Former VP Product Growth at Instacart, Instagram

Mistake #3: Ignoring Second Order Effects

Bad Power User thinking only considers the direct actions a user takes, such as consuming content or making a purchase. This thinking overlooks actions that create value through second order effects. For instance, in a content-driven social network, creating content may be a less frequent action for most users, but it is ultimately the action that drives the entire growth engine. In this example:

An overly simplistic Power User definition would only look at the top 1% of "engaged" users, defining engagement by all platform activity. This would overemphasize users who have more frequent consumption activities and could miss users who have less frequent, but more impactful, content generation activities.

A Power User definition that takes second order effects into account would recognize that content creation ultimately generates more value for the product.

In addition to helping hone your Power User definitions, looking at second order effects protects against the Power User Trap by surfacing situations where Power User behavior can harm the product ecosystem. Understanding second order effects will help you balance Power Users' needs against other users' and avoid falling into the over-catering side of the Power User Trap.

Mistake #4: Being Led Astray by Typical "Growth Math"

"Normal growth accounting causes you to mess up your product because the math tells you to think about casual users."—Fareed Mosavat, Reforge Partner, ex-Slack, Instacart, Zynga

Most Growth and Product teams prioritize initiatives using some version of an ICE framework: Impact x Confidence x Effort. One of the flaws of this framework is that audience size tends to dominate Impact calculations. As a result, teams end up focusing on the largest audience, which consists of more casual or new users. This can lead to The Power User Trap by neglecting power users.

Reforge EIR Adam Grenier faced this dilemma at Hotel Tonight. As their audience expanded from business Power Users to more casual consumers, the team began building engineering-intensive product features that consumers were asking for (e.g., ways to view more photos). Unfortunately, these features had little impact on stickiness or other growth metrics.

To avoid being led astray by the pressure to target the biggest audience, ask yourself the following questions during prioritization:

Do your growth efforts affect PMF for your Power Users? Features focused on growing casual usage can negatively affect the Power User experience (e.g., notifications that drive new user engagement can overwhelm Power Users). Regularly audit the Power User experience to make sure you're still delivering value.

Have you validated that new audiences have similar Power User behavior? New audiences can differ from your current Power Users significantly, requiring major product investments to achieve Product-Market Fit. For example, when Instacart initially expanded beyond dense coastal cities into less-dense Midwestern metro areas, they assumed their Power User behavior would remain the same. However, they missed that users with lengthy, car-based commutes were less willing to wait for a two-hour delivery window and instead were more interested in pick-up options. Instacart had to invest significantly in building out an in-store pick-up option to achieve Product-Market Fit in these regions.

Is your monetization model aligned with the activities of power users? If your product's monetization model is not tied to user outcomes (i.e., it is feature or usage-based), it can be easy to overlook Power User activities that don’t immediately impact revenue. These activities, like evangelism and content creation, can be critical to your retention and growth loops, so you need to account for them when weighing how much to focus on new audiences relative to Power Users.

“In the happy state, monetization and Power User activities like evangelism are all moving in the same direction; however, that’s not always 1:1 aligned. You need to ask yourself two questions: 1) does the customer outcome result in a growth model input (i.e., new users via loops or evangelism); and 2) does your company have aligned incentives with your customer (aka, the monetization model is set on an outcome)? If the answer is yes to both, your highest revenue customer is likely going to be your biggest Power User on all fronts, even evangelism. If the answer is no to either, you will likely have multiple Power User definitions that you will need to account for and prioritize.”—Reforge EIR Elena Verna

A New Definition of Power User

Relying on common Power User definitions like L28 has led many products into the Power User Trap of either over-optimizing for these users or neglecting them. Instead, a new Power User definition can help you better identify the users who really matter for your product:

A Power User is an outlier in terms of their behavior and influence within your product ecosystem.

A Power User is also an outlier whether they intend to be or not. The conventional L28 Power User still fits this definition (they're an outlier in terms of frequency of engagement), but the important thing to remember is that a power user can be an outlier on many types of behavior and influence:

Monetization: Users who generate the most revenue may not fit in the L28 Power User definition because they may engage less frequently, but they're still an important Power User type to track!

Creation: This can be straightforward like content creation (e.g., posting on Instagram), but it can also include setting up the infrastructure that allows other users to get value from your product (e.g., creating channels on Slack).

Feature Engagement: There are users that be outliers in the number of features they use in the product, but maybe show up as "core" if you just look at the frequency of usage.

Audience growth: These are actions that bring new users to your product (e.g., invitations that convert, referral codes). You can also look at the negative: are there actions or behaviors that drive users away from your product?

Costs: Not all outliers are positive. Some users may be outliers in terms of support requests, server costs, or customization needs.

The above list is not exhaustive. Use it to spur your thinking about the behaviors that meaningfully impact your growth loops, and then identify the outliers within those behavior types. You will likely identify multiple Power Users because outliers on one dimension are often not outliers on all dimensions. Ultimately, this more nuanced Power User definition will help you avoid the traps of either over-optimizing for Power Users to the detriment of your larger audience, or neglecting the Power Users who truly drive growth.

The Different Types of Power Users

While your Power User definitions should be tailored to your specific product, they likely align with some common archetypes. To help you get started, we have assembled a Field Guide to Power Users, which outlines some of the most common and important types and highlights how different Power Users can fit into your strategy.

The Field Guide to Power Users is divided by product type, with sections for Consumer Social, Marketplaces, Direct to Consumer products, and B2B products. However, these divisions are somewhat porous; more complex products may have Power Users from different divisions, and you may even encounter hybrid Power User types. As you read the Field Guide, bear in mind that your product will likely have multiple Power Users.

Consumer Social

Example products: Clubhouse, Instagram, Facebook

Consumers

Power Lurkers

Example: Passive content consumers on Instagram, Twitter, etc

How to identify:

Outliers in terms of content consumption

Extremely infrequent content creation

Possibly the minimum viable profile

More follows than followers

Advantages:

Can monetize (ad impressions)

Potential to convert into higher value users

Can generate value for content creators, benefitting ecosystem

Risks:

Can be confused with other, more valuable users if Power User definition is imprecise

Overinvesting in these users, trying to get them to be something they're not (content creators)

Power Engagers

Example: Non-professional, highly active Instagrammers

How to identify:

Outliers in terms of overall engagement (overlaps with L28 definition) for both content creation AND consumption

High quality profile

Follows and followers are more balanced, often leaning toward more followers

Advantages:

Drive growth loop by attracting friends and fostering engagement

Reinforce platform's best practices, culture, and norms

Source for stickier content (personal and authentic)

Strengthen content ecosystem by re-sharing and amplifying other creators' works

Risks:

Easy to overlook these users: small in number, produce less content than Power Influencers (see below)

May have off-platform influence, could attract your audience to alternatives

Creators

Power Influencers

Example: Celebrities, Instagram influencers

How to identify:

Platform activity skewed toward content creation

Drive disproportionate amount of content engagement activities

Outliers in terms of number of followers

May use higher friction or premium creation features

Likely have significant off-platform reach through traditional or social media

Advantages:

Key players in growth loop by driving content flywheels

Can serve as first adopters and ambassadors for new features

Risks:

Can be tempting to over-optimize for Power Influencers, blocking out other creators and degrading the ecosystem

Tend to be your most vocal complainers; if alienated, these users can draw audience to alternative platforms

Power Spammers

Example: LinkedIn spammers, toxic content creators on Facebook

How to identify:

Metrics can resemble Power Influencers, but content is lower quality

May directly generate revenue by paying for audience reach

Negative second order effects: engagement with Power Spammers drives away other users

Advantages:

Can be a near term source of revenue: willingness to pay for audience

Polarizing or unpopular content may engage some users

Risks:

Degrade ecosystem by crowding out quality content, ultimately driving away users

PR and brand risks

Power Spammers may be more likely to violate Terms of Service or abuse platform

Marketplace

Example products: Uber, Airbnb

Demand

Power Whales

Example: Uber Black business traveler

How to identify:

Big, consistent spenders: outliers in terms of transaction frequency AND transaction value

Lower price sensitivity, may use higher margin features

Advantages:

Consistent source of high margin activity

Strengthen marketplace by generating high value transactions for suppliers

Valuable user research subjects: studying these users can surface opportunities to improve the product or expand PMFs

Risks:

Lessons from Power Whales may not be generalizable to broader audience

Low ceiling: audience size may be capped and reach saturation quickly

Potential for negative second order effects on Supply or on other customers

Power Minnows

Example: Uber Pool commuters

How to identify:

Consistent, small spenders: outlier frequency but lower value transactions.

Higher price sensitivity: frequent discount code usage, lower margin transactions

Advantages:

Drive marketplace liquidity: can provide the Demand needed to grow and retain Supply

Potential to form habits and become less price sensitive over time, growing into Whale

Risks:

May be unprofitable to retain in the long run

Price sensitivity can lead to painful swings in liquidity if prices fluctuate

Power in numbers: mobilized minnows can create PR challenges and demand product changes

Supply

Power Suppliers

Example: Professionalized multi-property Airbnb host

How to identify:

Individual with disproportionate effect on supply availability (one additional Power Supplier adds more than one unit to the marketplace)

Frequent, consistent transactions

Advantages:

Provide marketplace liquidity and consistent supply

May offer a more consistent experience than smaller suppliers

Sticky: have invested to build presence on your platform

Risks:

Can dominate the supply side of marketplace, crowding out smaller but higher quality supply

Brand risks: by dominating transactions, Power Suppliers become tied to your brand

Power Gems

Example: Lifestyle Airbnb hosts with one unique, high-quality property (e.g., treehouse)

How to identify:

Outlier quality and value to users: most-unique offerings, top user ratings

Frequent transactions, near maximum allowed by their supply

Low ceiling: may only provide one unit of supply to marketplace

High overlap with early adopters

Advantages:

Provide great experiences that improve retention and drive word of mouth for demand side of marketplace

Can be strong community members, influencers, and ambassadors

Provide the "secret sauce" and special experiences on your marketplace that strengthen the brand

Risks:

Low ceiling: this audience may become saturated and have limited growth potential

Not representative: Power Gems may have different motivations and jobs to be done from most suppliers on platform

Less sticky: have invested less in platform, may be able to take transactions with loyal customers off platform

Direct to Consumer (Consumer Subscription)

Example companies: Peloton, Harry's, Spotify

Power Loyalists

Example: Peloton subscriber with Bike+, Tread+, and merchandise purchases

How to identify:

Near ceiling of possible transaction frequency

High margin activities

Low price sensitivity

Advantages:

May be your highest value customers, consistent source of high margin transactions

Valuable user research subjects: can provide insights into how your product meets their needs and how it can improve

Risks:

Audience has low ceiling and limited growth potential, can hit saturation early

User needs may not translate to broader audience

Serving these users may distract from efforts to expand PMF and grow audience

Power Evangelists

Example: Outlier referral code users

How to Identify:

Outlier in terms of attracting other new users to the platform (e.g., through referral codes and social media mentions), disproportionately drive viral loops

Consistent, frequent product usage

High NPS

May not be maximal spenders, margins may be lower

Advantages:

Propels viral loops (referrals, social)

Potential opportunity to convert into Power Loyalist

Valuable user research subject: learn what drives their positive experience and use to improve product

Risks:

Diminishing returns as product moves into mainstream

Abusive behavior (e.g., referral code scams) can be confused with authentic evangelism

Over-catering to this user can reduce margins or incentivize abuse

Power Savers

Example: Discount-only purchasers

How to Identify:

High transaction volume

Outlier discount and promotion usage (most transactions are discounted)

Streaky usage, coincides with promotions

Advantages:

Build overall customer and transaction volume, top-line growth

Can unlock operational efficiencies for physical products

Suggest Adjacent User expansion opportunity

Risks:

Abusive behavior can hide in this user type

Low margin users may be unprofitable to serve in long run

May indicate a lack of PMF: understand these users' motivations before investing too much in them

B2B

Power User thinking takes on additional layers in the B2B realm. Since many B2B models require thinking on a company or account basis, we will first look at organizations as types of Power Users, and then look at the individual Power Users within the organizations. Note that whether a person is a Power User can be independent of whether their organization is a Power Organization (i.e., an individual may be a Power User in a non-power org and vice versa).

Organization Power Types (Power Organizations)

Power Monetizers

Example: Large multinational using Concur for expenses

How to identify:

Outliers in terms of organization size and overall usage

Low maintenance: requires little customization, does not push limits of product functionality

Individuals likely required to use product, have little influence in purchasing decision

Common for top-down, sales-driven B2B products

Advantages:

High revenue and margins

Sticky customers with low churn

Risks:

Very competitive to acquire, high friction to onboard

Market trends (bottoms-up B2B, BYOD) reducing size of this audience

Stable revenue stream can hide individuals' unhappiness with the product, creates potential for disruption

Power Divas

Example: Large fintech adopts Slack, requires customization for compliance

How to identify:

Similar size and revenue to Power Monetizers

BUT extremely vocal, are outliers in terms of support and customization requests

May require significant product changes to acquire and retain

Advantages:

High revenue, potentially high margins

May push you to expand PMF, unlocking growth and expansion

Risks:

High-cost to acquire and support

Require taking on product, execution, and compliance risks; efforts to meet Power Diva demands can lead to product bloat

Distraction from other customer segments: requires strong point of view on why you should serve Power Divas over other segments

Power Feature Users

Example: Hubspot customer that uses full breadth of offerings

How to identify:

Outlier in terms of breadth and complexity of feature usage

Early adopter of new features, frequent source of new feature requests

May not be a large or high-revenue organization

Advantages:

May push you to expand PMF through new features, unlocking additional growth

Sticky: uses your product for multiple critical workflows

User research value: often have insights into the next best features

Risks:

Can overlap with Power Divas, may request extremely niche features

May be costly to serve, especially if feature usage pushes product boundaries

May not be representative of broader user needs

Individual B2B Power Users

In addition to the Power Organization types, B2B companies must recognize and serve different individual Power User types. The relative priority of different Power User types may shift depending on whether you're focused on acquiring a customer, initial adoption, or engagement and retention.

Power Champions

Example: The engineer who gets a company on Slack

How to Identify:

Highly influential within the organization

May have made the first download or first contact with your Sales team

High overlap with Power Builders (see below): high rate of invites and "foundational" actions

High willingness to try new features

Advantages:

Drive adoption and stickiness

Can smooth Sales process

Promote norms and best practices in the organization

Risks:

Influence is a double-edged sword: alienating these users may cause them to lobby for a replacement

Often extremely vocal, but may not represent broad user needs

Power Builder

Example: IT manager for initial setup

How to Identify:

One of the first users in the org

Likely has admin account or maximum permissions

Dominates "creative" or "foundational" actions in the first days of product adoption

Takes disproportionate amount of actions that affect entire org

Advantages:

Drive adoption and stickiness

Promote norms and best practices in the organization

User research value: high awareness of failure cases and edge needs

Risks:

High impact and reach: weak or not-bought-in Builders hurt product experience across the org

Influential: alienating these users may cause them to lobby for a replacement

Power Engagers

Example: PMs on Slack and JIRA

How to Identify:

An outlier in terms of usage rates (daily and intraday) across a diverse range of actions

Closely aligned with the traditional L28 idea of a Power User

Advantages:

Drive stickiness within organization

Generate engagement from non-Power Users

Risks:

Mistaking high engagement for satisfaction: Engagers may be unhappy and advocate for alternative products

Negative second-order effects: may worsen other users' experience through overuse or bad product habits

Power Specialists

Example: Finance team using JIRA to track R+D capitalization

How to Identify:

Outlier usage of less popular features

Product usage may be infrequent but high intensity

Advantages:

May reveal new use cases and PMF expansion opportunities

May overlap with Builders or Decision Makers (see below); satisfying these users may facilitate product adoption

Risks:

Specialists may serve as gatekeepers: their unique need must be met before the product can be adopted broadly

Prioritizing Specialists over other Power Users can create opportunity for competitors

Continuing to support Specialist features can have costs for the product as a whole

Power Decision Makers

Example: CFO, Head of Engineering

How to Identify:

Outlier in terms of influence in the purchasing decision but overall product usage may be low

Named in contract or payment method, present in later-stage sales calls

May overlap with Specialists

Advantages:

In cases where Decision Makers overlap with other Power User types (e.g., the CFO using an accounting platform), buy-in and adoption can be easier

Risks:

Friction in sales and onboarding process: extra effort may be needed to "sell" the Decision Maker on new features and upgrades

Misbalancing Decision Maker's needs against other users' needs may result in large number of unhappy Power Captives

The above guide should be viewed as a starting point for thinking about Power Users. You should customize and tailor definitions to your product; you may even see some of your Power Users demonstrate hybrid or overlapping behaviors among types.

Understanding Power Users is a powerful tool for driving growth, but you need a clear point of view on how they fit into your broader strategy to avoid falling into the Power User Trap. Reforge offers a number of resources that will help you hone your ability to identify Power Users and craft your product strategy, including our Retention + Engagement Deep Drive, Product Strategy, User Insights, and Advanced Growth Strategy programs.