Adam Grenier is an EIR at Reforge. He was most recently VP of Product and Marketing at Lambda School and has spent 16 years running marketing and growth functions for companies including Uber, HotelTonight, and Zoosk, as well as digital media for clients like Microsoft, Sun Microsystems, JCPenney, and Budweiser.

Scott Tousley is an OIR at Reforge. He's the head of marketing for HubSpot’s startup program. He's spent the past 6 years at HubSpot leading the freemium acquisition strategy team, building the first PQL monetization model, and scaling new acquisition channels globally.

With contributions by Keya Patel (OIR at Reforge, former Director of Product Growth at Headspace, Monetization PM at Dropbox), Mark Fiske (Operating Partner at H.I.G. Capital, former VP of Marketing at Credit Karma and Ancestry), and Brittany Bingham (VP of Marketing at Guru, former SurveyMonkey and RaiseMe).

Feel free to nod awkwardly at your screen if this situation sounds vaguely familiar ...

Your board member's niece (who has 75,000 TikTok followers) says YOU ARE CRAZY for not marketing your Enterprise B2B AI SaaS Data Storage company on Clubhouse.

If you've been in growth or marketing for more than a few years, you've likely been in this situation. Maybe the players have changed:

Your CEO instead of your board member

A podcast someone heard instead of their board member's sage wisdom

And instead of Clubhouse it was... TikTok, Poparrazzi, Instagram Stories, Yo, WhatsApp, Facebook Groups, Meercat, YikYak, Google Plus, Twitter, iOS apps, YouTube, The Amazing Race, interactive billboards, Saturday morning cartoons, the Howard Stern Show, smoke signals, or hieroglyphics.

Every time there is an emerging channel, there is curiosity, appeal, and horror in answering the inevitable question...

🤔 Should we invest our time and resources into this emerging marketing channel? 🤔

Having ridden this wave (or been crushed by it) for almost all the channels listed above, we decided to share our framework for emerging channel exploration. In this post, we’ll review:

What exactly are “emerging” marketing channels?

But first, let's clarify our definition.

What exactly are "emerging" marketing channels?

In this article, we are discussing emerging channels, which we'll subdivide into three groups:

Fast-growing new platform - These are apps like Clubhouse, TikTok, Poparazzi, etc

Alpha or Beta feature within an exiting platform - This is when Facebook permitted mobile advertising in 2012, Instagram launched Stories in 2017, and Google created their own social network in 2010.

Mature platforms under-leveraged by the industry - Such as when mature platforms (ex. Craigslist or Wordpress) are leveraged for the first time by a business in that industry (ex. ridesharing or CRM software).

1. A fast-growing new platform

These are the most obvious examples of emerging marketing channels. They are platforms like Clubhouse, TikTok, Poparazzi, etc.

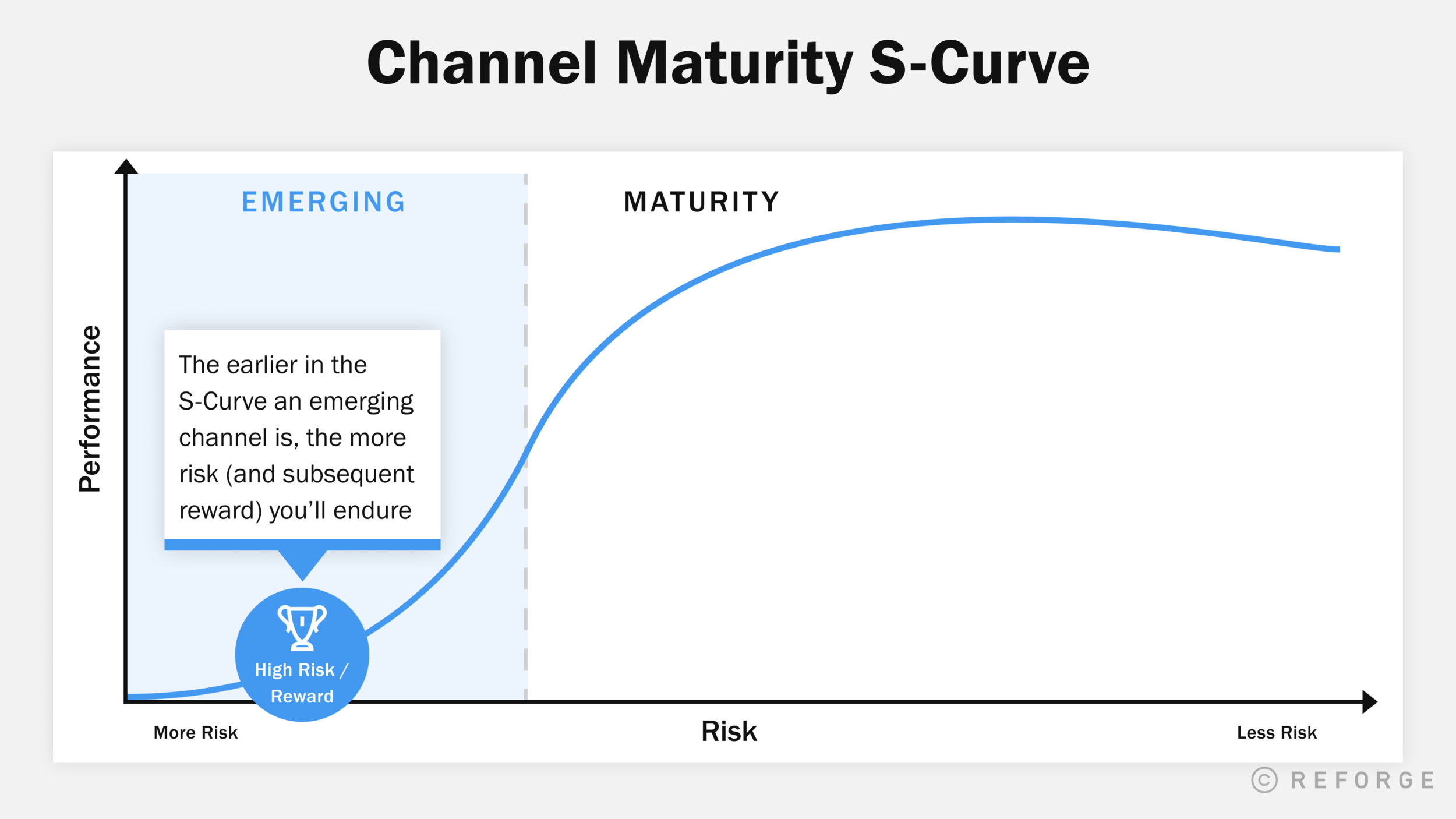

They're emerging platforms (typically social networks or marketplaces) in the channel maturity stage of the S Curve:

We cover the fine details of channel adoption curves in our Marketing Strategy Program, so we won't dive into specifics.

But the short version is you'll endure more risk the earlier you are in the S-Curve, but at the opportunity to reap the benefits of lower competition and more impression share. As you move up the S-Curve there is less risk, but typically more competition and higher prices.

For example, there are over 10 million Clubhouse WAUs (Weekly Active Users). Clubhouse is a Series C startup who raised $110 million. You can argue they're in the later stage of emerging channels.

In contrast, consider the Series A startup, Poparazzi, who raised $20 million. They're in the early stage of the emerging channel curve and inherently have more risk. You might be able to tap into Poparazzi, but there's also risk that the company fails to get traction and fails. The more immature the company, the higher risk (and subsequent reward) you'll endure.

2. Alpha or Beta feature from existing platform

A slightly more unconventional definition of "emerging channels" are when existing platforms announce Alpha or Beta features.

For example, such as when Facebook created an Alpha feature for running Mobile Ads in 2012 and HotelTonight took advantage.

In 2012, Mark Zuckerberg made a public statement that they wasted 2 years ignoring mobile and intended to prioritize it moving forward. At HotelTonight, we saw that as an opportunity to be a first mover. However, we had a small team (and much smaller budgets!) than the traditional travel spenders, so we pitched Facebook on why we were a great partner for mobile ads.

We had a competitive advantage at HotelTonight. We knew the mobile ecosystem better than any other travel company, were known for amazing photography, and they knew, and were a leader in mobile advertising as a non-gaming company (something that they knew Facebook would covet in a very gaming-heaving ad market). This allowed us to position ourselves ahead of larger advertisers.

By helping Facebook test their mobile ads platform, we had exclusive access to mobile ad inventory before any of the traditional travel companies could start bidding against us.

— Adam Grenier, former VP Product/Marketing at Lambda School, head of Growth Marketing/Innovation at Uber, mobile marketing at HotelTonight and Zoosk

Another example is when Headspace took advantage of an emerging feature within Snapchat.

In early 2020 at Headspace, we were exploring ways to make significant strides in discussing mental health with younger generations (specifically gen Z). The company interest was accelerated as COVID forced students and young people to be in new environments and face much more uncertainty. Through research, our social impact team started to hone in on discussing mindfulness with an audience 18 years old or younger. We found Headspace could serve this population through existing social media platforms, like Snapchat, that this group was already using regularly.

Snapchat was an established platform by 2020, but they were launching a new product experience — mini apps made by third-party developers that run inside of Snapchat. Snapchat, and the new Minis experience, was a completely new channel to Headspace.

As a test, and to double down on the company's goal in thinking about mental health for the next generation, Headspace Mini launched with 6 meditations in July 2020. Headspace was one of the first to try out the Minis experience. And, in the first month of being live, over 5 million Snapchatters engaged with Headspace Mini, indicating mental health tools and resources were welcomed by the Snapchat audience.

— Keya Patel, OIR at Reforge, former Director of Product Growth at Headspace, former Growth and Monetization PM at Dropbox

Other examples are when Instagram created the Stories feature in 2016, Slack allowed companies to build Bots in 2018, and when Google Plus was created in 2011 (yes, some features have temporary success).

These are all transformational features that changed the trajectory of the platform. But it's the companies who got in early on these Alpha or Beta features that were fortunate to leverage massive returns of these emerging channels.

3. Mature platforms under-leveraged by the industry

Not all emerging platforms are "new" platforms. They are emerging relative to the industry.

For example, HubSpot had to diversify its user acquisition portfolio and landed on a platform that was created in 2003.

In 2019, the majority of freemium user growth was coming from organic search and paid social. We had two reliable and scalable user acquisition channels, but we still had to diversify our acquisition portfolio.

We weighed our options and landed on doubling down on Wordpress. The reason was not because Wordpress was a new platform (built in 2003!), but the CRM industry was not leveraging Wordpress an acquisition channel in itself.

We built a flywheel that connected our organic search rankings to our partner's Wordpress plugins/themes, back to HubSpot's freemium Wordpress plugin, which converted into paying customers. Our growth team was compiled of a lead PM, engineers, designers, business development, and marketers to fully leverage this new play.

The biggest lesson we learned is that an "emerging" channel doesn't need to be a new trendy social channel. It just needs to be an emerging opportunity relative to who else is leveraging that platform in your industry.

— Scott Tousley, head of startup marketing at HubSpot, former freemium acquisition lead at HubSpot

Another example is from Mark Fiske who led marketing at Ancestry.com.

At a time when most .com marketers thought of digital as the primary distribution channel, Ancestry.com recognized that the vast majority of media consumption was on linear television.

Further, our demographic viewed more television than any other and CPMs for 30 seconds of sight, sound and motion were often less than static digital assets!

By focusing on leaning into and understanding the direct response applications of this traditional channel, Ancestry was able to dramatically scale profitable growth, leapfrogging traditional .com competitors stuck in a myopic shiny object digital channel mindset.

— Mark Fiske, Operating Partner at H.I.G. Capital, former VP of Marketing at Credit Karma and Ancestry

One final example is from Brittany Bingham who led Growth Marketing for SurveyMonkey (now Momentive).

While it was broadly known that Facebook boasted some of the most powerful ad targeting and widest breadth of audiences of the established ad networks, it was historically underutilized by B2B SaaS businesses.

Given the variety of use cases that customers would use SurveyMonkey for, segmentation became critical to the channel's efficacy. We were able to utilize Facebook's lookalike models based on anonymized existing customer attributes in tandem with highly tailored ad creative and demographic targeting (tailored towards those use cases) as a highly effective acquisition strategy.

By stepping back from the predisposition that Facebook could not be used for a B2B business, SurveyMonkey was able to scale the contribution to new accounts from Facebook from a "test channel" to a reliably performant source from a profitability (CPA/LTV ratio) and absolute volume perspective.

— Brittany Bingham, VP of Marketing at Guru, former Sr. Director at SurveyMonkey (Momentive) and VP of Marketing & Growth at RaiseMe

A counter-example is if you’re a dropshipping ecommerce brand who is spending money on Facebook desktop ads. Or if you're a B2B SaaS company who is trying to squeeze as much life out of Google's organic search as possible. Or if you're an insurance company spending money on cable TV advertisements. These are hyper-saturated mature channels for each given industry.

We are looking for mature channels that are underutilized relative to the industry. Not mature channels that have become industry standard.

What are we not covering in this article?

Finally, let's be clear what we will not be covering.

1. "How to choose your next acquisition channel" - We are presenting a framework for making a yes/no decision on dedicating time and resources to an emerging channel. We will not be discussing choosing SEO vs. paid vs. virality. Those are mature and well-established channels. We cover this material in detail in our Marketing Strategy Program and Growth Series.

2. "How to choose your first acquisition channel" - This decision can make or break your success. But it's not something we're covering in this article. Choosing an emerging channel as your first channel can work if you're a new startup, but it's extremely high risk. You may get early mover advantage, but if the platform fails, you're back to zero with a limited runway.

Ok, let's get into the framework!

Introducing: The emerging channel framework

In this article we'll give you framework to figure out if this channel is worth your time and energy. Here is a sneak preview.

But first, you need a bit of breathing room to deflect the question from your board member/CEO. Here's a gift to you:

Hi _____CEO/BOARD MEMBER/NIECE,

As usual, thanks so much for keeping our business and customers on top of your mind wherever you are. It's this level of excitement for our mission that gets me out of bed every morning and truly inspires me.

Our team is always exploring new ideas, so we'll be sure to add this one into our mix. I may reach back out to share ideas or ask for some connections - but in the meantime you can trust it in our hands. For your reference, we approach new channel discovery using a similar framework as the one Reforge posted about earlier this year. It's worth a read on how to approach new channels - both for your own interest, and to give you context into how we'll approach this and other channels or ideas like it.

Cheers,

YOUR NAME HERE

Now that you've got some space to think, let's make the most important decision - should we invest our time and resources into this new channel?

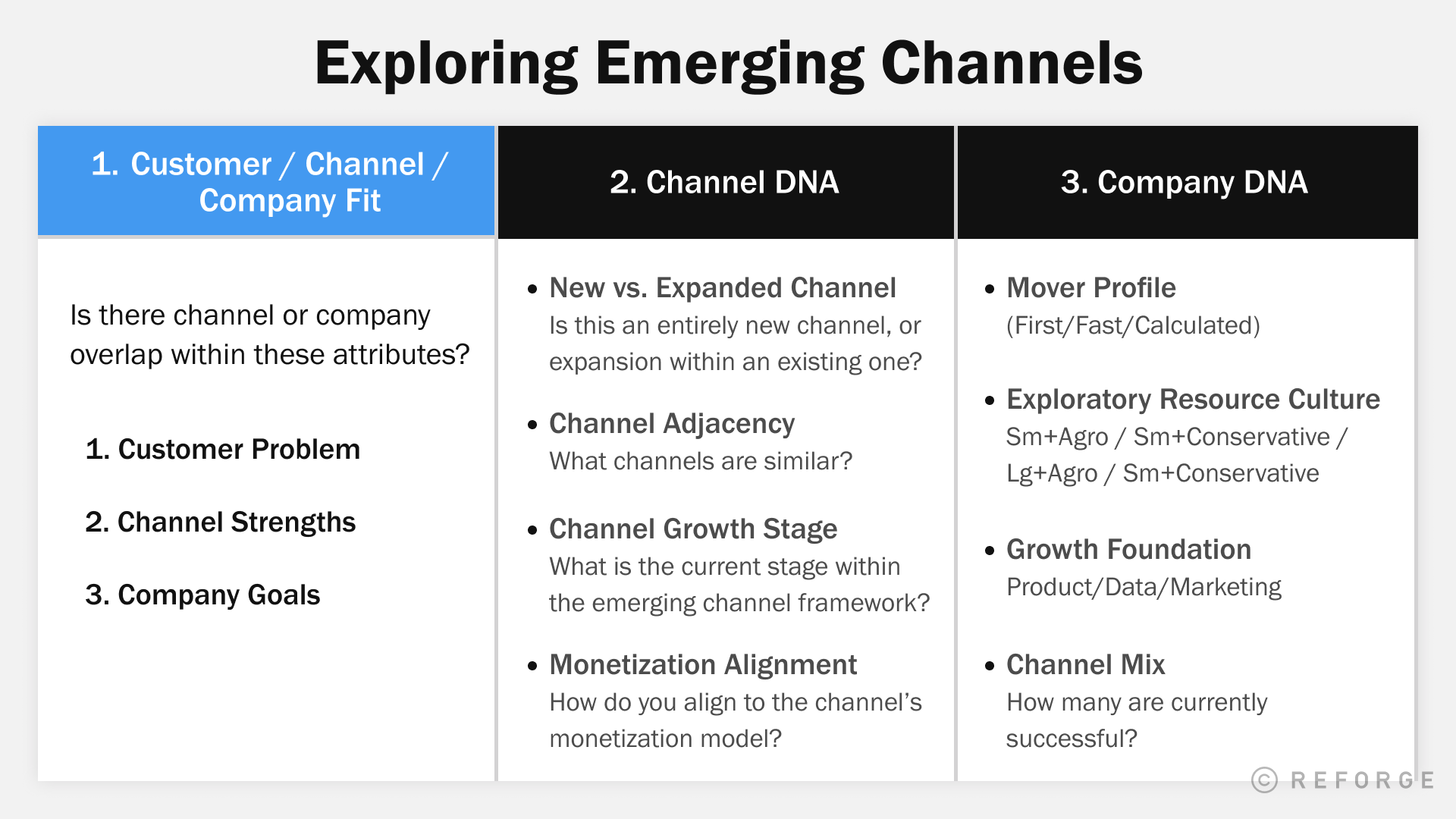

We will cover three fundamental components:

Your Customer:Channel:Business Overlap

The Channel DNA

Your Company DNA

We'll then cover a handful of examples at the conclusion of the article. For example, should Spotify explore Clubhouse? Should Salesforce explore Poparazzi? Should Snowflake explore TikTok?

Let's dive in!

1) Customer:Channel: Company Overlap

If you gain nothing else from this framework, we implore you to take the time to map out why you're considering this new channel in the first place. We will be evaluating the customer problem, channel strengths, and company goals. What we're looking for is overlap between all three.

Here is a bit more detail for each one.

Now let's look at a few examples.

Example: Spotify and Clubhouse

Let’s pretend we are Spotify. We’re deciding how much time and resources we give Clubhouse. For Spotify, there's clear overlap in all three of these bubbles.

They're both audio-based entertainment platforms. Spotify is heavy on high-production quality whereas Clubhouse is low-production quality, but feels more conversational. Yet they both operate in the same wheelhouse.

So, it’s probably safe to assume, internally at Spotify they're keeping a keen eye on the role Clubhouse may play in access, discovery and community-driven audio. This doesn’t mean that it’s a great use of resources for them, simply that it’s not crazy for them to at least explore it.

It's important to keep in mind that this framework will not give you a magic formula to spot the perfect opportunity that will 10x growth. It's simply a starting point to gauge if this is worth spending more calories thinking about the possibilities to tap into this channel.

Editors Note: A few days before publishing this article, Spotify announced Spotify Greenroom which is their new rival to Clubhouse. We wrote this two months ago so you're welcome to officially call Adam and Scott savants and encouraged to let them to predict everything in your marketing and product future.

Example: Spotify and Poparazzi

Playing on the Spotify example, let's take another emerging channel — Poparazzi. There just isn't channel overlap in the inherent nature of Poparazzi and Spotify.

While Clubhouse is inherently audio-based, Poparazzi is inherently photo-based. Despite them both being successful emerging channels (at different stages along the S Curve), there is not enough channel overlap between Poparazzi and Spotify. Therefore, we would not consider this too much further in our evaluation.

This first step should be light and easy. It's a good filtering mechanism to take a step back and ask why you should be thinking about this channel in the first place.

2) The DNA of the channel

Now that we’ve decided the alignment of the channel to our business and customer, the second step is exploring the nature of the channel. There are four key channel attributes that we'll dive into:

2a) New vs. Expanded Channel

2b) Channel Adjacency

2c) Channel Growth Stage

2d) Channel Monetization Alignment

Each of these attributes can help you formalize how aggressive in both speed and resources it will likely take to successfully explore the channel.

2a) New vs. Expanded Channel Offering

Key Question: Is this an emerging channel inside an existing platform OR an entirely new channel?

New channel opportunities can live both within and outside of existing channels. For example, Clubhouse is an entirely new channel whereas Twitter Spaces is expanding within the current platform. If you already have authority in an existing platform, the ability to test is likely going to easier than testing on an entirely new channel because you'll have existing resources.

For entirely new channels, it requires higher ambiguity. Perhaps no one has done this before, data may be less reliable, you have no framework internally on how to approach it, and you're borrowing resources. You’re not flexing a team you already had in place to deal with the existing channel. Instead you’re pulling resources away from other initiatives to attempt something more undefined.

As a result, a new channel will often require more resources than channel expansion. This does not immediately make Twitter a better decision, because we must consider user growth of each platform. However, if you already have a team playing there, it's easier if you’re light on resources.

2b) Channel Adjacency

Key Question: Is this an entirely new category you’re exploring OR one that you’ve played in before?

It's important to identify channel adjacency. For example:

The "mobile app" ecosystem followed very similar trends as the original digital internet ecosystem in terms of consumption behavior, data, and customer adoption. VR as a growth platform is showing early signs of a similar cycle.

Craigslist and job boards as an acquisition channel for the gig economy garnered a lot of learnings from the evolution of paid search, SEO and traditional classified ads.

YouTube fought for years to try and grow as a direct response channel, but more and more the value looks like traditional TV and billboards (eyeballs vs. clicks).

Ideally, you can pull insights over from a category you've already dabbled in. For example, if you've spent millions on paid social brand ads, an adjacent channel is TV brand ads. Whereas product integrations with strategic partners falls a bit outside of your paid social brand ads scope.

Using our Clubhouse example, you could potentially garner learnings from audio and/or social communities. In audio, this is learning from the successes and failures of talk radio, Pandora, Spotify, podcasting and Alexa. In communities, this is learning from Quora, Twitter and Reddit. These may provide some adjacent channel examples of how Clubhouse (or whatever new channel you're considering) may evolve in time.

In other words, if you’ve been successful with adjacent channels, you should feel more comfortable testing. Plus, you may require less resources with your given experience.

2c) Channel Growth Stage

Key Question: Where on the S-Curve is this channel?

As we mentioned in the introduction, we're covering purely emerging channels.

Within the S-Curve there are levels of along the emerging channels. The earlier in the S Curve the more risk (and subsequent reward) you'll endure.

When a channel first enters into the ecosystem, there are few (if any) foundations or rules. It's also when the buzz rarely ever meets reality. One of the best signals to whether something is still in traction even if it feels like it's leapfrogged into the Golden age area is when there's a single, homogeneous community. Apps like Meerkat and Yo are great examples. They spread very quickly within a specific audience, which made anyone in tech or around SXSW take note, and start making predictions and giving them attention as if they were already the next Facebook. Over time they failed to gain any long term or broader reaching traction and left a lot of time wasted. This isn't to say you shouldn't make bets at this stage, just that the likelihood of success is still incredibly low for the platform as a whole, so the weight of your bet and resources should align appropriately.

While Clubhouse is still relatively small compared to TikTok, Snap and Twitter, you could say they're now starting to proceed past Early Adopters. This means that the ceiling is much higher and the likelihood of failure has decreased. It's not a sure bet, and there's still a wild west aspect to how companies can/should leverage the platform, but signals including multiple use cases (large conference + small event + smaller intimate conversations), monetization strategy (creators), several audiences (tech, comedy, theater, real estate, public speaking, etc.), notable repeat users, and follow on funding suggests it has foundation to work on.

Be cautious with channels still in their early traction phase. Generally speaking, the earlier in the S-Curve, the more cautious you should be, as there is significant risk the entire channel will flop. Go with more confidence once you see retention and diversity in the audiences using the channel and others successfully using the platform for marketing purposes.

2d) Channel Monetization Mapping:

Key Question: How can you help the channel make money by aligning with their monetization model?

The best way to maximize channel growth is to help them make money. If you help the platform generate revenue, it will increase behind-the-scenes opportunities to work with that platform in more depth in the future (ie., Alpha or Beta feature access).

For example, consider Slack, who many companies are starting to think about as a significant growth channel. They are a communication and service platform, so their revenue comes from both company and individual subscriptions that enable communication. If you are a media or content company, Slack may be high on your list of places to be an innovative force. Why? Because content drives conversation. And conversation makes Slack money. Taking this approach rather than just "I'm going to create a slack bot" gives you the ability to approach Slack as a serious partner and be at the cutting edge of their developer platform.

As another example, let's look at Clubhouse. It appears they're leaning towards monetizing as a creator platform. If you're currently thinking about Clubhouse as a channel, ask yourself questions like "how can we enable creators on the clubhouse platform" or "could we bring our creators to the clubhouse platform." For many, this may flip your original instincts on their head. Suddenly, Clubhouse as a growth channel may be more interesting to companies like Miro (create live, interactive inspiration boards during hot sessions) and SubStack (plugins that make Clubhouse clubs out of your subscribers and enable private subscriber shows). Or companies like AirBnB may think about it as a way to engage with the host and real estate community first rather than consumers first.

The real opportunity to unlock channel innovation to your benefit happens when your business needs, your customer needs and the channel's needs all align. If you can align your exploration along with a channels monetization vision it will significantly lower the potential friction you’ll face when looking at the channel itself for help and resources in your success.

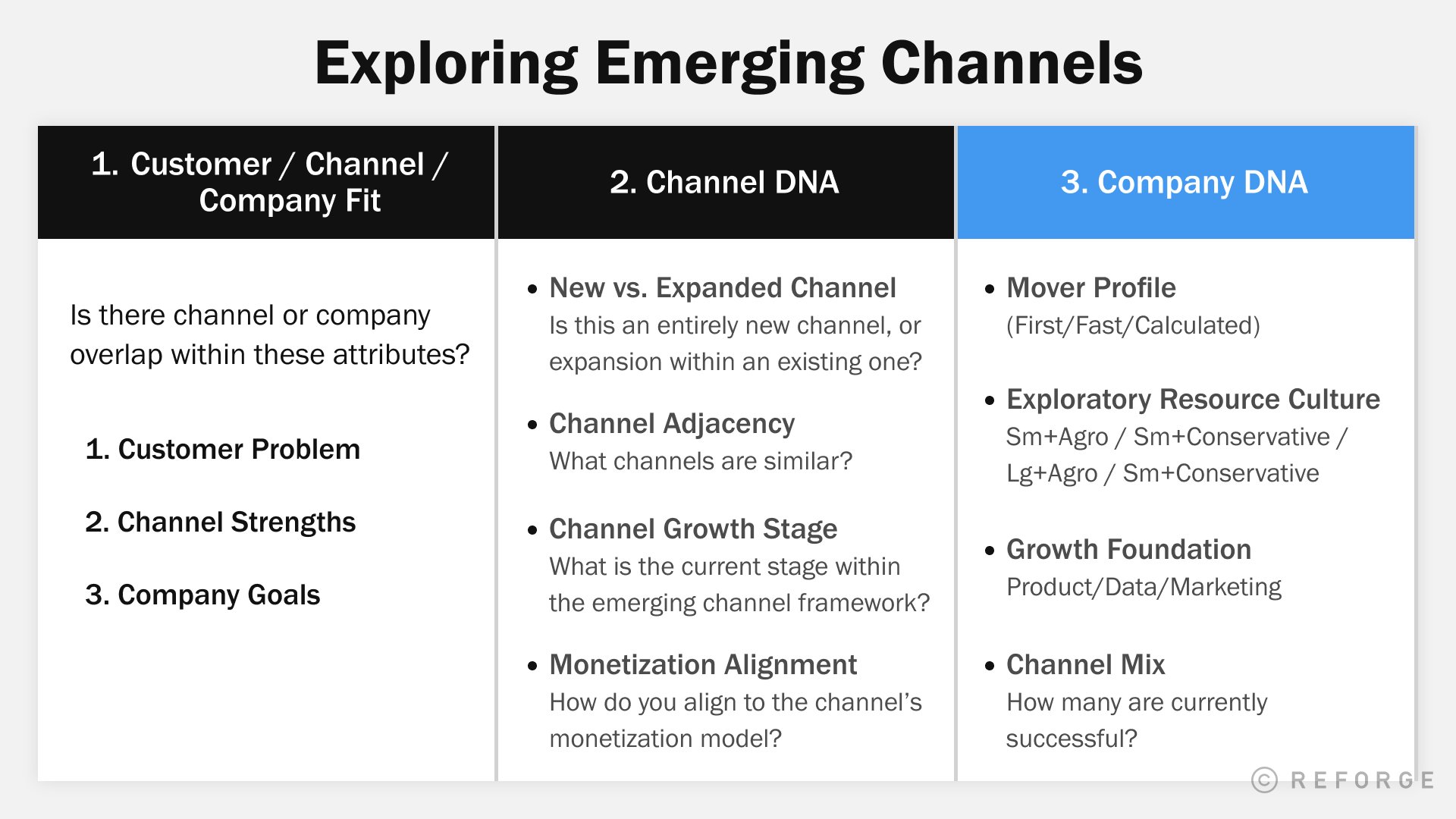

3) The DNA of your company

Let’s dive now into how your own DNA as a company might influence your decisions. There are three key company attributes we’ll examine:

3a) Mover Profile

3b) Exploratory Resource Culture

3c) Growth and Channel Foundation

Mapping the DNA of your company and team can give you introspection necessary to make sure you explore in a way that’s scalable and disciplined, and not misaligned with your culture.

3a) Mover Profile

Key Question: Is your company typically a First Mover, Fast Follower, or Calculated Settler?

This helps us understand how quickly we want to move into this channel. First Movers are at the front gate the moment the gate is considered. Fast Followers invest in observation and resources to move quickly once there’s a signal. Calculated Settlers have a clear road map of what pieces they need to operate in a new channel at full capacity on day one.

Almost everyone thinks they're a "First Mover" when it comes to adoption of emerging channels. But few have the opportunity or disposition to genuinely take that first dive into a new channel. Let’s break down the various approaches here and their pros/cons.

First Mover (Ambiguity + Volatility + Timing)

The upside of being First Mover is that you get to be one or two steps ahead in learnings vs. your competitors and the market. You may afford yourself weeks (if not months) before others figure out a platform and get massive efficiencies early on before the channel becomes saturated. And, depending on the channel, the audience, and your willingness to buy in, you may find you’re able to block out competitors during early stages of a channel’s development.

However, most growth, product and marketing teams simply aren’t comfortable entering into a world with no data and automation. The risk profile is too large. Many don’t have the resources to tackle a channel before anyone else has started to lay a path that works. Let alone the obvious risk that the new channel fails and your time is wasted.

An important callout is emerging channel adoption is rarely, if ever, a zero sum game. The traditional “startup” benefits of being a First Mover don’t apply given the reality that, if successful, everyone will find and use this channel as well. You “own” basically none of it.

Fast Follower (Less Friction + Less Control)

Where most channel innovators actually land is within the “Fast Follower” category. That is, they enter a channel once they see a little bit of a signal. Once it’s there, they go fast and furious.

The benefits of being a Fast Follower are many. You’re able to learn from the First Mover wins and losses, so you’re able to approach it more strategically and with more refined resources. You’re also entering at a later stage in the channel development (even if by weeks), so you’re benefiting not just from the First Mover, but from the channel itself adapting to the First Mover.

The downsides here are that you have less control. That is, if the First Mover built a path specific to their business, the efficiencies of following that path may not align 100% with your core needs. Things like pricing, formats, and customer rituals may already have foundation before you make your first move.

You’ll also lose out on some of the potential efficiencies of the First Mover, but for most companies that are truly able to move fast, the gap won’t be terribly large.

Calculated Settler: Data Driven Adoption

Where most companies actually fall is into the Calculated Settler profile. If find yourself regularly saying “we’re data driven” the odds are that you won’t thrive in a true First Mover or Fast Follower experience. Channels at this stage are early in what they can offer, which means being super accountable and repeatable in your wins are less common. Which, simply, won’t jive with how many of us have built our growth and marketing teams.

The key here is figuring out exactly what you need to feel comfortable playing the role of a Fast Follower so you’re on the bleeding edge of adoption when it does have the ingredients you need. Is it tracking? Is it structured pricing? Is it a set of tools to automate? Is it volume? Is it a competitive presence? Knowing this about yourself can help you identify if/when you should say yes to the “should we” question, and make sure that you’re not blindly following the crowd over a cliff you’re not equipped to jump over safely.

3b) Exploratory Resource Culture

Key Question: What is your company's resource allocation culture when it comes to exploration?

Once you know your Mover Profile for new situations, next it’s important to understand how much weight you’ll want to put behind your decisions when you approach an emerging channel.

It’s important to understand your human resources, how frugal you are with time or money, and the competitiveness of your industry. Each of these will give you a sense of how aggressive you should consider investing in emerging channels.

Team Size

The biggest driver for most people will be who will be thrown at this new challenge. Is this a marketing manager, an ops person, an intern, the CEO, or do you need to pull in designers and engineers? If you have a 300 person team covering all these bases, pulling a few resources into this challenge is likely a much less costly decision than if you’re a small team of four people.

Resource Frugality

Do you have $20m in the bank and a revenue generating business? Or are you an early bootstrapped company with a short runway? Do you have a roadmap to hire 30 new people this quarter, or hope to get by with the team you have on hand? Do you have a team of passionate people who love dipping into new opportunities on the weekend? You likely have a quick sense of your company's approach to new opportunities. Some are going to swing for the fences every time, most are going to be more frugal unless they know something is a sure bet. Knowing this answer can help approach both the resources you throw at a new opportunity, or how to pitch (for or against) the opportunity internally.

Competitive Nature

While we are firm believers that competition should not drive your key product strategy, knowing what’s going on around you is going to be very important. If you’re in an all out battle on all your other channels right now, unlocking new channels before anyone else might be a key advantage you have prioritized in your business. However, if you’re in a well established market already, letting the industry go suss out the new channels for you while you save time and energy and fast follow, might be a more natural fit for your company. It largely depends if you're in a winner-take-all industry such as a hyper-competitive marketplace that needs balanced supply and demand (Uber, Airbnb, OfferUp).

If you have a smaller team, more bootstrapped approach to spending resources, or a less intensely competitive environment, you likely are better off minimizing your investment in a new channel, or taking a wait or see approach. If you are a large team, willing to win at all costs or have an intensely competitive industry, you may consider taking a more serious investment out to explore new channels.

3c) Growth and Channel Foundation

Key Question: Does the foundation you’ve built your growth team and existing channel mix on enable exploration in a productive way?

It's important to understand how this emerging channel fits within your existing foundation. How you built your growth team is a massive influence to how you’ll approach emerging channels.

Growth Team Makeup

Building a growth team is a series of articles all on it’s own. However, most tend to be built around a product management or performance marketing, with a few emerging from data teams.

If you’re coming from a product management foundation, the ability to throw a new external channel exploration into your product roadmap tends to be an expensive ask. The main exception to this rule is if this new channel may, in fact, be a new platform you’re operating on. For example, a new browser or mobile operating environment that exposes you to totally new audiences or a new payments platform that enables more international adoption. Otherwise, it’s often more valuable to partner with other teams (i.e. marketing, social, operations, etc.) to do the early exploration.

If you’re coming from a performance marketing foundation, it may be a bit easier to divert your attention to a new channel given you’re likely on a more always on, iteration based timeline. The three main traps marketing teams fall into with new channels are:

Diverting attention from existing channels: The next section touches on this a bit, however it’s important you do still assess your prioritizations and make sure you’re not losing momentum on proven channels before you pull resources into exploration.

Wasting valuable design, data, and engineering resources: Appreciation for your internal partners is one of the most important skills marketers need to develop. It’s easy to get excited by new channels and pull in a lot of other resources prematurely. These teams often have many other things on their table, so be thoughtful when you lean on other organizations.

Lazy use case mapping: While insights from other marketing efforts should absolutely be used when entering a new channel, that does NOT mean you should copy and paste everything you’ve done before. Each channel will play a different role for your customers, so taking the time to understand this mapping will greatly increase your odds of success on this new channel.

Product:Channel Mix Maturity

In addition to the team, it’s important to understand what growth loops and marketing channels you’ve already got working for you, and what the risk/reward of adding this new channel into the mix might have.

The most basic way you can assess this, is how many channels or loops are currently driving growth for you?

No Channels: If you’re starting new, and have no channel traction yet, you should be incredibly cautious of trying emerging channels. We see this trap often, where entrepreneurs would rather innovate than do things the way they’ve been done before. For example, here's what Mark Fiske shared with us on this common pitfall:

A common pitfall is prioritizing sexy new technologies before having the basics in place. Often I'll be asked about applying machine learning or AI to marketing challenges and be forced to level set with the brand. If you aren't optimizing to lifetime value at a granular level, don't understand diminishing returns from media, or don't have a smoothly functioning marketing machine covering the basics — it's imperative you solve for that first. Without foundational basic best practices in place it'll be incredibly challenging to take advantage of new and emerging tools & technologies.

— Mark Fiske, Operating Partner at H.I.G. Capital, former VP of Marketing at Credit Karma and Ancestry

Prioritizing an emerging channel over existing scalable channels is a dangerous game. The biggest exception is if your business is emerging with the emerging channel. For example, if you’re building a startup on top of Slack, Zoom, or HubSpot, getting traction from their platform may be as important to your business as other channels.

1 Channel: Much like someone just starting out, if you’ve only seen success with one channel, you likely still have some serious consideration to make for other existing scalable channels. The additional layer here is to have a real honest talk with yourself to understand why only one channel has made it. Are you just that early? Are you a squirrel running from one opportunity to the next without giving them time to succeed? Is there something that just makes other channels not a fit? The two environments we’d encourage more exploration at this stage are if the emerging channel is within that existing environment you’ve already seen success, or when you’ve seen huge success with that first channel, but haven’t seen success on other channels despite smart time investments.

2+ Channels: This is the goal with channel exploration. You’ve got a few channels rolling and scaling, your team has taken shape, and you’re good at taking things from infancy to maturation. This is also a great way to pull your earliest team members (those you hired at generalists vs. specialists) and leverage their core strengths. You’ll still want to be careful of the flags we’ve outlined before, but you should feel more comfortable with high-risk exploration when you’ve got a multi-layers foundation in place.

Generally speaking, if you’re a product-driven growth team or you have few existing channels working for you, you’ll want to deprioritize high-risk channel exploration, unless there’s a ridiculously clear opportunity for your business. Otherwise, see if you can pull resources from teams and efforts where it won’t slow you down from making investments on your foundational growth levers.

👩🔬 Exploration in Practice 👨🔬

As a reminder, here is our spreadsheet template for channel exploration. Feel free to make a copy for discussions with your team.

We'll now dive into a few examples as we explore channel exploration in practice.

Example: HotelTonight on Facebook Mobile Ads

from Adam Grenier

In 2011, the mobile advertising landscape was VERY different than it is today. For mobile-only companies like HotelTonight, there were only a few sources of external growth opportunities, primarily search, display, and incentive ads (i.e. “Download this app to get 10 carrots on FarmVille!”).

Meanwhile, at HotelTonight, the team had seen great success with display ads, their referral program and leveraging incentive ads and features in the AppStore to get a lot of early traction. Google AdWords were never a huge piece of the strategy because of the relationship they had with hotels, and incentive ads weren’t a sustainable strategy because of saturation in the AppStore and changes in the AppStore rules.

So, In 2012, when Mark Zuckerberg made a very public statement that they wasted 2 years ignoring mobile, and intended to prioritize it moving forward, the HotelTonight team saw that as an opportunity to be a first mover. However, they had a very small team and much smaller budgets than the traditional travel spenders. So rather than taking a full bore approach, they focused two employees part time efforts on building a relationship with the team creating the mobile ads solution at Facebook. Not the sales team.

They focused on why HotelTonight was a great feature partner: HotelTonight was known for its’ amazing photography, they knew the mobile ecosystem better than any other travel company, and were a leader in mobile advertising as a non-gaming company, something that they knew Facebook would covet in a very gaming-heaving ad market. This approach matched both the channel nuances AND the business DNA of HotelTonight. And by becoming one of the Facebook Ads launch partners it allowed HotelTonight to have a voice in the build of the units themselves, and most importantly, gave them months of access to the platform and inventory before any of the traditional travel companies could start bidding against us.

As a result, here's how we'd fill out our spreadsheet.

The spreadsheet is meant to lead you with guided questions to help answer the question IF it's worth proceeding with the channel.

In this case of HotelTonight and Facebook Mobile Ads, it certainly made sense, and we were fortunate to see massive upside from it.

Example: Uber on Craigslist

from Adam Grenier

In 2013, Uber had just launched UberX and was focused on getting drivers to attend in-person onboarding sessions in each of their markets. Up to this point, driver acquisition was mostly a local recruiting effort where operations teams would literally call professional drivers up or engage with them in the local offices. Some marketing was in place, but it was very ad-hoc and inconsistent from one market to the next. Through in-person customer interviews, the growth team learned that some of the drivers were finding out about the on-boarding from a single craigslist post that the operations team had placed a few days prior. They reviewed across markets and learned that several cities used this strategy, while some larger ones had felt they weren’t able to get any value out of posting on the channel.

The makeup of Craigslist was a mixed bag. Here you have this well known channel for local job discovery, but it has no foundation for scaling as a marketing channel, unless you’re selling cars. There was no way to put in tracking links, any understanding of things like impressions and click through rates, automated posting wasn’t possible, pricing varied from free to post to different per post prices by market, there were restrictions on posting frequency, and there wasn’t even a sales team at Craigslist to interact with.

Uber’s growth team was a product team with an embedded marketing group. So they decided to take a single marketing person and a contractor to start doing some tests on Craigslist to see if they could suss it out as a marketing channel. After only a couple weeks of testing they realized they could definitely garner efficient traffic from Craigslist and leverage the local teams to help scale it as a channel through processes and technology to automate aspects of the process without breaking Craigslists terms and conditions. Over time, they were also able to leverage the data they collected to work with Craigslist to get API access to scale within their boundaries.

Within a very short amount of time, Craigslist became an incredibly efficient channel with little upfront investment from Uber. However, it also became a capped market because of channel restrictions, and now is massively saturated by competitors. So it’s still a valuable channel for many gig economy companies, but the true exploration value had a very short window of opportunity for it to garner the results it did Uber.

Here's how we'd fill out our template spreadsheet for Uber and Craigslist.

Example: HubSpot on WordPress

from Scott Tousley

In 2019, the majority of HubSpot's freemium growth was coming from organic search and paid social. We had two dominant and reliable user acquisition channels so our eyes were set on diversifying our acquisition portfolio.

We weighed our options and landed on doubling down on WordPress. The reason was not because WordPress was a new platform (built in 2003!), but the CRM software industry was not leveraging WordPress an acquisition channel in itself.

We played around with our strategy for a few months until we nailed a scalable framework. We built a flywheel that connected our organic traffic to our partner's Wordpress plugins or themes, back to HubSpot's freemium Wordpress plugin, which converted into paying customers. Our growth team was compiled of a lead PM, engineers, designers, business development, and marketers to fully leverage this new play tapping into the Wordpress ecosystem.

The biggest lesson we learned is that an "emerging" channel doesn't need to be a new trendy social channel. It just needs to be an emerging opportunity relative to who else is leveraging that platform in your industry. In our case, very few of our competitors were taking Wordpress seriously in the CRM software space.