This post was co-authored by Elena Verna (Growth Advisor and Former SVP Growth at Malwarebytes/SurveyMonkey) , Dan Hockenmaier (CEO @ Basis One and former Growth @ Thumbtack), Patrick Campbell (CEO at Profitwell), and Brian Balfour (CEO @ Reforge, Former VP Growth @ HubSpot) as part of the upcoming Reforge Monetization + Pricing program.

Elena Verna

Growth Advisor Former SVP Growth at Malwarebytes/ SurveyMonkey

Dan Hockenmaier CEO @ Basis One Former Growth @ Thumbtack

Patrick Campbell Co-Founder & CEO @ Profitwell

Brian Balfour

Founder/CEO @ Reforge. Former VP Growth @ HubSpot.

There has been increasing sentiment in the tech echo chamber that, instead of growth, companies need to be focused on profitability, unit economics, and monetization. A lot of the shift has been driven by unicorn companies in certain verticals falling flat in the public markets or even going out of business altogether. There are many reasons why each high-profile company has struggled after raising mountains of VC money, but the bigger picture has actually been missed.

It's not about growth or monetization, it's about how monetization feeds growth as part of a holistic system. Additionally, there are macro-economic factors making it more difficult for all tech companies to succeed. The game is constantly changing.

As we spent hundreds of hours creating the Monetization + Pricing Deep Dive, we found ourselves coming back again and again to the same conclusions:

Acquisition costs continue to increase due to limited channels, increased competition, and disappearing data tailwinds.

This means that Monetization will become a more important lever in our Growth Model. There is a false belief that Monetization comes at the expense of growth, this is incorrect.

Despite this, Monetization doesn't get put on equal footing as Acquisition and Retention due to a number of internal company issues that create friction.

These factors create a growth opportunity for teams that are willing to embrace the inherent challenges and put Monetization on an equal footing with Acquisition and Retention.

Let's dive a little deeper on each of these.

Acquisition Costs Continue To Increase

Limited Channels

From about 2002 through 2016, there were constantly new scalable channels to tap into (Facebook, YouTube, Instagram, Snapchat, etc), all with large untapped audiences. This meant ongoing new acquisition opportunities for tech companies focused on digital acquisition. However, for the past 3 - 5 years, we've been in an ecosystem where the number of scalable channels has been decreasing (or staying the same) vs expanding.

Increased Competition In Those Channels

On top of that, as the costs of building software startups have decreased and the market sizes have increased, we've seen increased competition in all of those channels. In other words, demand for a limited number of acquisition channels has increased while supply has stayed roughly the same. On top of that, competition in nearly every market segment is increasing. So there are also more companies selling competitive products to the same target customers. As you can see below, companies that started 5 years ago entered the market with only 2.6 competitors on average in their first year. But companies that have launched in the past year enter the market with close to 10 competitors in their first year.

Data Tailwinds Becoming Privacy Headwinds

One of the ways that businesses have mitigated increased competition is by using better data and new marketing tools to be far more targeted in their acquisition efforts. In addition, we've seen that access to data drive efficiency improvements on paid platforms such as Facebook. Easy access to mountains of customer data acted as a tailwind, helping to keep the good times rolling. But with GDPR, privacy concerns, and other pending regulation, data tailwinds are likely to become headwinds.

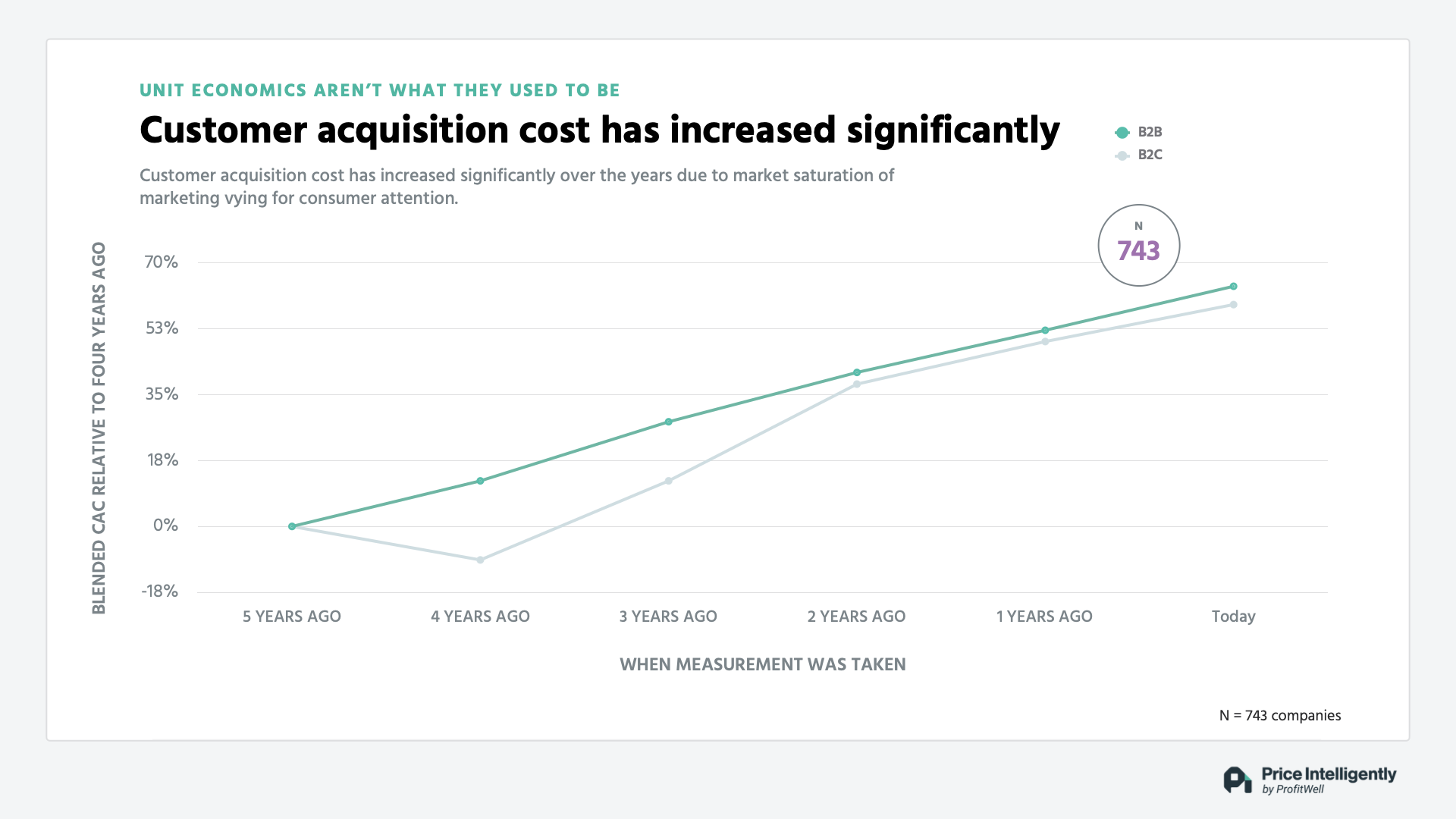

The End Result Is Rising CAC

The end result of all of this? Cost of customer acquisition has been rising and will continue to increase. As you can see in the data below from ProfitWell, customer acquisition cost across all channels is close to 60% higher for both B2C and B2B companies than it was 5 years ago. This is before the privacy headwinds have truly started to blow.

So, what does this all mean?

Focus On Another Part Of The Growth System...

In every Reforge program, one message we hammer home is that growth is a system. The simplest representation of that system is three pillars: Acquisition, Retention, and Monetization. We believe that the system is best represented in the form of compounding Growth Loops.

Because growth is a connected system, as you authentically improve one pillar of the system, the other pillars improve and enable new opportunities elsewhere in the system. In the right circumstances, this can become a positively reinforcing cycle. We've previously written about how improving retention and engagement improves acquisition, monetization, payback periods, and your competitive advantage.

The same principle applies to Monetization. But there is a false belief that monetization comes at the expense of growth. This is wrong. Your monetization model enables or disables growth loops in your overall growth model. If you understand your growth model, you will be able to make improvements to monetization that enable growth.

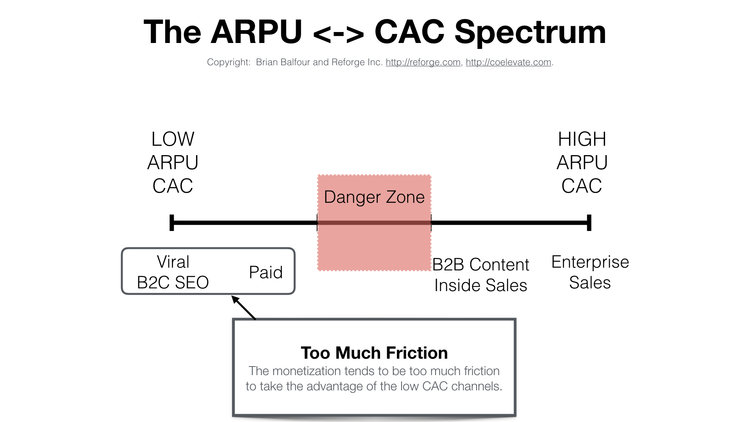

One of the core concepts of the Four Fits Framework is Channel Model Fit. Channel Model Fit states that your monetization model either enables or disables various growth loops. We worked through this during early versions of HubSpot Sales product.

At one point, we had a freemium tier priced at $25 per person. We found that the friction from price and other monetization elements was too high for a touchless sales growth model. And the model didn't create a high enough ARPU in order to use a sales-assisted model. In other words, we were in the ARPU/CAC Danger Zone:

We had to reconfigure the model by increasing prices, changing the packaging of the tiers, and other elements. As we made adjustments, increased average revenue per customer, and aligned other pieces of the monetization model to the target customer, it opened up the sales-assisted loop in our growth model, while keeping the viral loop we had in the free tier. This put the product on a path that would eventually exceed $100M in revenue.

This is one quick example. There are multiple levers to monetization, and each of the levers presents opportunities for improvement. Each monetization improvement you make will open up new acquisition and retention opportunities. In fact, even during the golden era of digital acquisition (2008-2016), monetization improvements had the biggest impact on revenue improvements.

Monetization Isn't On Equal Footing

Despite rising costs, decreased willingness to pay, and the impact Monetization has across the growth model, at Reforge we see a magnitude more resources, effort, and experimentation put on Acquisition and Retention over Monetization.

When was the last time the price changed for your product? Or a component of your monetization model? Or even an element on your pricing page? Compare that to how long ago and how frequently you changed something with acquisition or retention, and my guess is you'll find a stark difference. You are not alone. You can see in the below graph that most companies only spent between 5 and 15 hours on pricing in the last year. And pricing is just one of many levers to monetization.

In other words, Monetization is almost never put on equal footing. Why? There are four core reasons.

1: Sacred Cows

For most products, monetization decisions are set early. The specifics are typically the result of mostly guess work. Then, if the product is successful a false positive feedback loop occurs. Because the product grows, we believe that our monetization decisions were accurate. As a result, the organization builds a belief that monetization should not be changed.

2: Fear of The Customer Revolt

When someone suggests a change to monetization, the common veto card of "customers will revolt" is often used. It makes sense as pricing changes gone wrong are often heavily publicized. In 2011 as Netflix increased its prices, a customer revolt and the refrain "Netflix is going to die" were heavily publicized.

But did you also know that Netflix has changed its pricing 8 times since April 2014 in the US alone and has still grown from $1.3B in revenue to $5.5B in revenue in the same time frame? In fact, those pricing changes are one of the reasons Netflix revenue exploded during this timeframe.

Source: Recode Daily

In fact, the fear of the customer revolt actually increases your chances of a customer revolt. The longer you go without changing your monetization strategy, the bigger the hole you dig yourself, then the bigger the eventual change you need to make.

Evernote was a good example of this. In 2000 they launched the product with three tiers to their pricing. Then, a bunch of competition came into the market. For a long time, Evernote didn’t change prices, afraid they’d alienate their strong user base. It wasn't until 2016, (16 years later!) they bit the bullet, limiting the features on the free plan and increasing prices of their premium plans. They were met with a HUGE revolt from their subscribers, even though the alternatives were priced in a similar range.

People react more negatively to the size of the relative change and how you communicate that change vs the frequency of change. Dan Hockenmaier who worked on Growth at Thumbtack has a good snapshot of this:

"As we evolved the monetization model at Thumbtack, it meant changes in pricing for many of our service pros. They were understandably sensitive to these changes - it impacted the way they ran their businesses. But we found that if we got out ahead of the change and clearly communicated what was happening and what to expect, the reaction was much better." - Dan Hockenmaier - Growth Advisor, Basis One, Former Dir of Growth @ Thumbtack

You need to set the tone early and often that monetization and pricing will change and evolve. The prospect of the customer revolt is a reason to change your monetization MORE, not less.

3: More Stakeholders = Less Change

Want to slow down or kill an initiative? Easy, get more people involved. That is exactly what tends to happen with monetization efforts. Changes can impact finance, sales, customer success, marketing, and product teams. Everyone wants their say, but typically every function has their own chain of command and decision-making process. You not only end up with more people but also different processes to make decisions. It ends in a tangled mess of getting nothing done.

4: Misunderstanding Of The Levers

When people think monetization, they immediately think of price changes. The amount you charge is just one of several monetization levers. What you charge for, how often you charge, how your price scales, how you combine and package all of those things, and how you communicate it are just a few of the other levers. The lack of understanding leads teams in the wrong direction and ends in more failures vs successes. Dan Hockenmaier goes further:

"Not only is price given too much attention, it is the one lever that is almost purely zero sum - either the business or the customer keeps an incremental dollar in their pocket. But other levers can be positive sum - simply making it easier to transact or easier to understand what you're paying for can remove a lot of friction from the buying experience." - Dan Hockenmaier

Their Difficulty, Is Your Growth Opportunity

After seeing thousands of rapidly growing products and companies through Reforge, there are two things that we have come to believe:

Look at what everyone else is doing, and do the opposite.

If everyone is focused on acquisition, that likely means there is an opportunity for innovation elsewhere in the growth model. But more specifically when it comes to Monetization:

"An interesting dichotomy I've noticed: teams internally know their pricing was set with limited data or structure. But they assume their competitors went through a highly rigorous process to set price, and so they anchor on what competitors are doing. Unless you're in a highly established, highly competitive space, it's usually better to build your monetization strategy from the bottom up, by deeply understanding customers and willingness to pay. Your competitors are often just guessing as well" - Dan Hockenmaier

Embrace the hard stuff to get outsized returns.

Your competition has all the same barriers and misconceptions as everyone else, and as a result, it also means they are unlikely to be prioritizing monetization efforts. If your competition isn't focused on something, it is likely an opportunity for you. Right now, there is an opportunity for many product teams to put Monetization on an equal footing with acquisition and retention efforts.

Want to learn more about Monetization? Reforge is currently accepting applications for the Spring 2020 Monetization + Pricing Deep Dive. You can apply here.