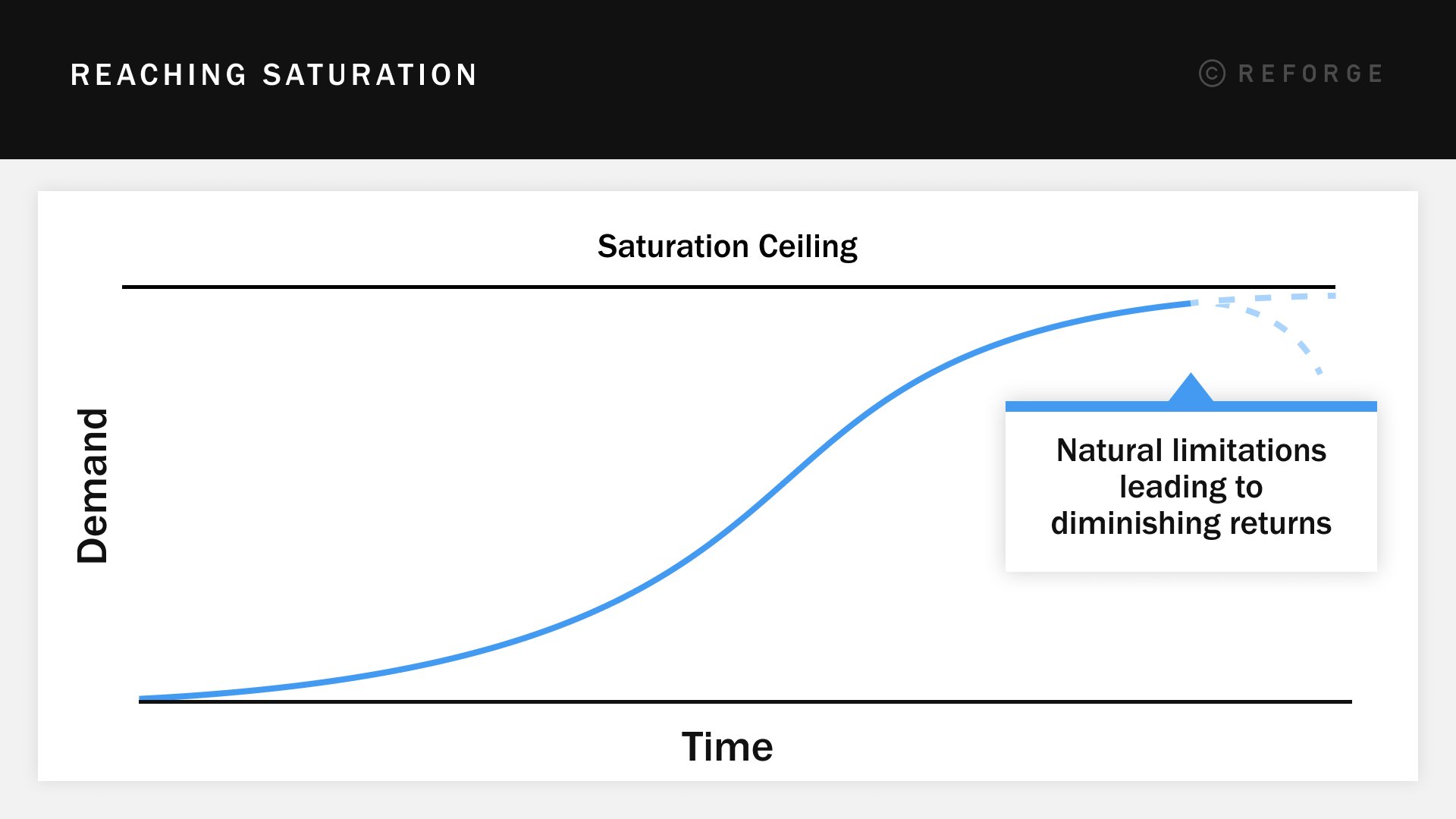

As your company scales, it will naturally approach market saturation. Growth rates will start to slow, and you’ll need to expand into new user segments, use cases, or geographies.

Saturation is natural, and actually something to be (momentarily) celebrated, as it’s usually a marker of initial product market fit.

At this point, many companies choose to invest in international growth. Yet most struggle to effectively grow their reach beyond their primary domestic market, due to three key factors:

Some aren’t thoughtful about if they should go international in the first place, so they end up either half-heartedly investing or over-investing.

Others struggle with knowing when the right moment to start investing is, so they start way too early (and burn a bunch), or way too late (and aren’t willing to invest enough)

Others have conviction they want to invest now, but they don’t know where or how: their investment fails to deliver, leading to mediocre impact or falling prey to local competitors.

These symptoms stem from a lack of thoughtful strategy. Startup pitches routinely insist the company can explode their total addressable markets by expanding internationally. From there, many companies (especially in the U.S.) will begin to lump together any customer outside their primary domestic country as “international” without any nuance or intentionality, layering global investments and resources together in one side of the org chart.

There’s a whole culture around overly-consolidated yet under-resourced international strategies, left alone in a corner to hopefully magically succeed. This rarely ends well.

Luckily, it doesn’t have to be this way. Over the last two decades, I have led both successful and failed international growth efforts.

With lessons from my own battle scars and the insights of other tech leaders, this piece will walk through:

The 3 incorrect assumptions that can deter international growth

The 3 inputs required to develop a tighter strategy: where, when, and if

We’ll also give you a chance to read through 4 detailed cases of international expansion, across different business models and company stages.

Valerie Wagoner is currently the Head of Product, APAC at Stripe. She was previously Chief Growth Officer of GoPay, the payments and financial services platform arm of GoTo, and VP International at Credit Karma. Prior to those experiences, she was the Founder & CEO of ZipDial before being acquired by Twitter.

Thank you to Natalie Rothfels for her deep collaboration on this piece.

Thank you to Julia Rudlin, Neo Zhizhong, and Oswald Yeo for contributing case studies from their deep international growth experience.

3 Harmful Assumptions that Deter International Growth

The prospect of growth can be very enticing. Many leaders jump all in. But jumping in without a clear strategy will make the ongoing decision to invest chaotic and difficult to reason about. I’ve seen countless examples of investment regrets that come from a few avoidable assumptions.

Harmful Assumption #1: Comparable Conditions

Leaders assume that the conditions that exist in their home market will also exist in other markets. Conditions can include everything from market regulations, to competition, to shared distribution channels, to core customer profiles and needs.

It may seem like you have organic growth in international markets, but that growth may be a false positive: It often doesn’t accurately validate your core user base’s needs, the viability to grow that initial base, or your understanding of how those people are using your product today. It is essential to anchor on the growth metrics that assess quality of usage to avoid the common pitfall of assessing only based on top-line vanity metrics.

For example, Twitter acquired my company ZipDial as part of the product strategy to grow user acquisition in India and other emerging markets. While the ZipDial acquisition was a great strategy towards this objective, once inside Twitter, I quickly realized that acquisition in India wasn’t the problem — retention was. Monthly active users were growing strong thanks to organic user acquisition from casual contact growth loops, but that segment’s retention was poor: A high volume of new users gave a superficial impression of product-market fit.

We quickly pivoted to focus on improving retention, and invested in several key strategies:

We built product features to improve both manufactured and environmental engagement loops

We improved onboarding to have more of a warm start so more users would be successfully activated and more likely to retain

We invested in a lighter weight app and less data-intensive experience for the India market, where the conditions weren’t comparable to other markets. In 2014, low-cost 4G networks were not yet rolled out across India. Customers would not continue to use a heavy app that burned through their normal mobile data consumption.

Leaders need to understand the conditions of each market they hope to enter so they can evaluate if those conditions are truly comparable or have unforeseen differences that will deter (or accelerate) growth, changing how attractive that market is to enter.

Harmful Assumption #2: Repeat ROI

Leaders assume that the core growth mechanisms that work in their home market will work and be ROI positive in other markets.

For example, if one of your product’s core acquisition levers is paid marketing through television ads, but you’re looking to enter a market where those ads are cost-prohibitive (or where television is not where your audience spends their time), the ROI on that acquisition lever is unlikely to meet expectations.

Let’s look at an example: Credit Karma grows based on Paid Acquisition Loops. In assessing international expansion, my team there evaluated both the ability to acquire users at low CAC (through measurement of the performance of TV and digital ads), and the ability to drive high LTV of users (thanks to banks, lenders, and credit card issuers being willing to pay high enough amounts for new customers). We validated our hypotheses through market research, partnerships conversations with lenders, and digital marketing tests.

Canada and the UK both proved to be markets where we believed we could drive low CAC and high LTV, and that anchored the strategy to expand. On the other hand, India proved to be a high CAC and low LTV market, so we chose not to expand there. This was a critical decision because our bureau partners were actually encouraging us to expand to India. Had we not visited the market and met in person with banks and lenders to truly evaluate their willingness to pay for new customers — the key driver of Credit Karma’s LTV — this investment would have likely flopped.

Leaders need to thoughtfully avoid those common mistakes that are made when comparing the ROI on market expansion, and establish a better POV on ROI.

Leaders need to thoughtfully assess the core growth mechanisms domestically, and what must be true for that mechanism to work in a new market, too. When core growth loops are already working well in one market, it’s easy to have collective amnesia around how much investment will be required to get that growth lever working abroad (more on minimum scope in our Advanced Growth Series program).

Leaders need to understand the customer segments that are likely to adopt in the market to get more accurate reads on the opportunity. It’s easy to assume that the total addressable market is the entire country without thinking about user segments on a more granular basis. In India, even though nearly 200 million users had a profile on the credit bureau, the vast majority only ever consumed credit very infrequently and only for loans on two-wheeler vehicles. No more than 30 million of these users had been underwritten for an unsecured personal loan or credit card. So the addressable market for Credit Karma’s core model was only 20-30 million of the nearly 1.4 billion people in the market — half the addressable market of addressable UK credit consumers.

Harmful Assumption #3: Market entry is incorrectly sized

Leaders struggle to look at the investment with right-sized expectations — either by wearing rose-colored glasses and assuming that market entry means successful investment, or taking the “dip our toe” approach and being unwilling to invest enough to see meaningful returns.

Deciding to invest in international expansion is an ongoing decision, not a static moment-in-time snapshot that’s never looked at again.

Instead, leaders need to have clear eyes about what needs to be progressively validated in-market to continue, strengthen, or reduce investment. This requires taking the time to thoughtfully consider the opportunity cost of international growth, and having a framework that helps you consistently re-evaluate your ongoing investments.

These 3 Assumptions Hold Across Both Types of Expansion Models

While companies approach international growth in different ways, these faulty assumptions hold true across the two types of expansion models:

Adjacency: acquisition occurs organically without market-specific efforts

Seed & Grow: acquisition occurs only after the company makes a concerted investment to launch in-market

Quizlet is an example of international growth through adjacency: UGC viral content loops drove acquisition and adoption from students across the globe before the company invested in any explicit international growth efforts. With adjacency growth, leaders are especially vulnerable to not evaluating the ROI, assuming they can more effortlessly ride the wave of organic growth.

On the other hand, products that require more upfront investment will take the seed & grow approach: That includes products that require local presence (like Uber, where both drivers and riders must be in a physical location to match) or geography-specific infrastructure (like Stripe, where payments regulations differ across markets). With the seed & grow approach, leaders are especially vulnerable to assuming market entry is a small upfront investment rather than an ongoing part of their portfolio.

All three of these harmful assumptions can lead to lofty consequences:

Over-investing in some markets while under-investing in others

Spreading investments too thin across too many markets

Exiting markets with layoffs and a wake of burned resources

Executing functional team playbooks that lack relevance to the local market context

Communication gaps between local teams who understand user needs and central global teams who make product decisions

Company leadership not having sufficient visibility into growth opportunities

Leaders can avoid these consequences by slowing down to develop a more thoughtful stance on whether or not to invest in international growth in the first place.

See how four companies explore international expansion at different stages of their growth. Get case studies on Credit Karma, Gilt, Geniebook, and Glints!

Where, When, If: The 3 Inputs Required to Develop a Tighter Strategy

It’s natural to think of international growth as a yes or no decision. But the question actually starts further down the decision tree: to evaluate the ROI and compare it to other expansion opportunities, you must start with a clear opinion on where to invest.

Where will we invest: What are the market conditions, and how do they impact our core growth mechanisms?

When will we invest: How does the ROI change with shifting market factors?

Will we invest: What’s the ROI, how does it compare with other market expansion opportunities, and are we set up to execute to win?

Let’s dive into each in detail.

How to Decide Where to Invest Internationally

Where help you understand the opportunity: the baseline of market attractiveness, how big of an investment you think you’ll need to kickstart your growth loops in that market, and if the core growth models you have competency around in your primary market will be ROI positive in another market.

To decide where to invest, you’ll need to do an ROI assessment:

Generate a list of candidate markets based on market attractiveness.

Assess which of those markets have a more attractive ROI based on shared capabilities.

Do a detailed analysis to assess growth model-fit and minimum scope required to successfully “enter.”

Once you understand these factors, you can more easily assess the ROI of each distinct market with a market attractive score and a shared capabilities score.

Market Attractiveness

This represents how meaningful the opportunity is. Many companies look at market size, competition, regulations, required operational expertise, and growth potential as inputs. More heavily regulated spaces (fintech, marketplaces, healthtech, gambling, etc) may dramatically change the opportunity size.

Shared Capabilities

Shared capabilities are what drive defensibility and differentiation. Knowing that entry into a market may require distinct tech, an endless list of localized features, or moving out of your company’s core competency can be humbling, and may shift how you think about investment size. Some companies may be able to enter in a market with just localized UX, but most have to do much deeper localization (from payments to partnerships to content creation and beyond).

Growth Model

Your growth model (especially how you acquire new customers) informs how cost-effective it will be to grow: kickstarting a sales team may require more upfront investment than expanding an in-product referral program to a new audience. Your growth model is critical to deciding where to expand: most people overly anchor on the market attractiveness without evaluating if the growth model will work across your target segments in the new market).

Minimum Scope

Lastly, minimum scope details what it will take, based on shared capabilities and your growth model, to effectively enter into a new segment or market. A product that expands through adjacency might find that minimum scope can be reached with UX and content localization. A company expanding through a seed and growth approach may require more to reach minimum scope: localized payment methods, different pricing structures, compliance with legal requirements, etc.

The question of “where” is ultimately about understanding what the ROI is:

Which markets are most attractive in terms of target size and shared capabilities?

What must be true to enter the market and kickstart our core growth loops?

What must be true to reach minimum scope on our growth loops?

How to Decide When to Invest Internationally

There is no one right time to expand, but you need to form an opinion on when to invest because the conditions of your success are not static over time: they change alongside markets, customer behavior, and other products. You don’t want to invest too early — at the expense or distraction of the core market — but you also need to invest proactively enough that growth hasn’t yet plateaued.

Thinking about strategic expansion proactively, leaders can look out for several dynamics that may influence their timing for international growth:

Market dynamics, including competitors and regulations

Product dynamics, such as network effects and customer tailwinds

Business dynamics, like fundraising and partnerships

Market Dynamics

Your product is unlikely to fit like a glove into every new market, so you need to understand the viability of each market uniquely.

Market Dynamic #1: Competitive landscape (and cost of entry)

The cost of entering the market may increase as competition increases, which can lead to higher customer acquisition costs.

When considering when to expand Credit Karma to the UK, our options were:

Expand fast and compete with other companies

Wait for those competitors to validate the UK market for the Credit Karma model

One of Credit Karma’s strategic advantages was having a large cash base and profitable business model, but the opportunity cost of existing leadership and engineering focus was too high to expand too fast. So we decided to wait, despite knowing that early adopter users were already being acquired (and we would face higher CAC later) and that valuations of competitive companies would increase as they scaled (in the event we wanted to acquire those competitors later).

Two years later, the timing was right. Ultimately we expanded to the UK via acquisition, acquiring the second seed player in the market. This gave us a faster time-to-market with an existing license to operate and a substantial user base.

Market Dynamic #2: Regulations

Regulations in one market may be less or more restrictive than in the home market, changing the dependencies on the roadmap and therefore affecting the timeline for expansion.

Fintech companies like GoPay or Stripe often require licenses to operate in many markets. The timelines for getting regulator approvals are impossible to predict with high accuracy, so it is important to sequence and gate incremental expansion efforts on the roadmap based on hitting key milestones from a regulatory process. Creating teams before regulatory hurdles are cleared creates a big execution risk.

Other regulatory requirements may also impact the ideal timing for expansion. Privacy laws like GDPR in the UK impact 100% of companies. At Credit Karma, we had to plan roadmaps for expansion into the UK, taking into account central platform engineering and operational investments that would be needed to comply. We had to make sure we were not prematurely expanding and forcing central teams to comply with such laws before they were operationally equipped to do so.

Product Dynamics

Core product value or engagement mechanisms may actually be enhanced by new market entry.

Product Dynamic #1: Network Effects

The value prop in one market may actually increase with the expansion into another, like with travel (Tripadvisor, Booking.com) or payments (Wise, Stripe).

Glints is Southeast Asia’s largest talent marketplace - nearly 2.7M job seekers and 45,000 companies have found matches on the platform. International growth was a priority early in the company’s lifecycle because of the cross-border nature of the job market in Southeast Asia. Prospective employers look to both hire people for regional relocation as well as hire into local offices across countries. The talent on the supply side seeks out similar mobility. Glints is a good example where the value of the product grows through expansion of the network across borders. Deciding when to invest, therefore, is influenced by how much more valuable the product as a whole can become.

Product Dynamic #2: Customer Tailwinds

Companies may choose to increase investment where there's a signal of organic traction, especially with viral or content loops.

Gilt, an e-commerce company differentiated by selling luxury goods at steep discounts, is an example where organic international user adoption served as an indicator that adjacent international user segments had appetite for the product. Despite the product experience being subpar (no support for local language or UX), there were organic users in some markets that mirrored the ROI-positive engagement and acquisition loops that drove growth in the US.

Business Dynamics

If expansion becomes more appealing to your company from an execution standpoint, that may also accelerate your decision to invest.

Business Dynamic #1: Fundraising Rationale

If fundraising is important for growing the core business in general, then using international expansion to help sell the vision may have an impact.

At a strategic level, international expansion benefits companies by expanding the addressable market and diversifying away from the core market in cases of concentration risk, which may be attractive to investors. However, I strongly recommend against pulling forward international growth investments too early for this purpose, because it can lead to distraction and failure to execute on the core market.

Additionally, overall product-market fit expansion should be the center of the fundraising story. International growth is just one candidate for product-market fit expansion that companies need to evaluate.

Business Dynamic #2: Partnerships

Many companies leverage partnerships to fuel their core product strategies or growth models. If such a partnership can help your company accelerate past minimum scope in your growth loops, you should capitalize on that opportunity, especially if the opportunity may disappear.

At Stripe, the product strategy and partnerships strategy are inherently linked: the readiness and motivations of our partner financial institutions are a big factor in how we time expansion efforts.

The question of “when” is ultimately about understanding how the ROI is likely to change at different points in time. Leaders should ask themselves:

What happens if we don’t invest now, but do in 12 months? 24 months? 5 years?

What do we believe to be true about entering this market now, and how long it’s likely to be until we see returns?

What are the conditions we need to see in the market before we believe the ROI makes sense?

See how four companies explore international expansion at different stages of their growth. Get case studies on Credit Karma, Gilt, Geniebook, and Glints!

How to Decide If You Should Invest Internationally

After analyzing the “where” and the “when,” leaders should have a lot more clarity on the true investment required to enter a new market, and how timing shapes the strategy. This is enough to start more meaningful discussions on whether to invest or not.

Those discussions should focus on defining and aligning around three key areas:

Where does international expansion fit in the investment portfolio?

What are the validation gates for continued investment?

What is the minimum investment to enable successful execution?

Where Does International Expansion Fit in the Investment Portfolio?

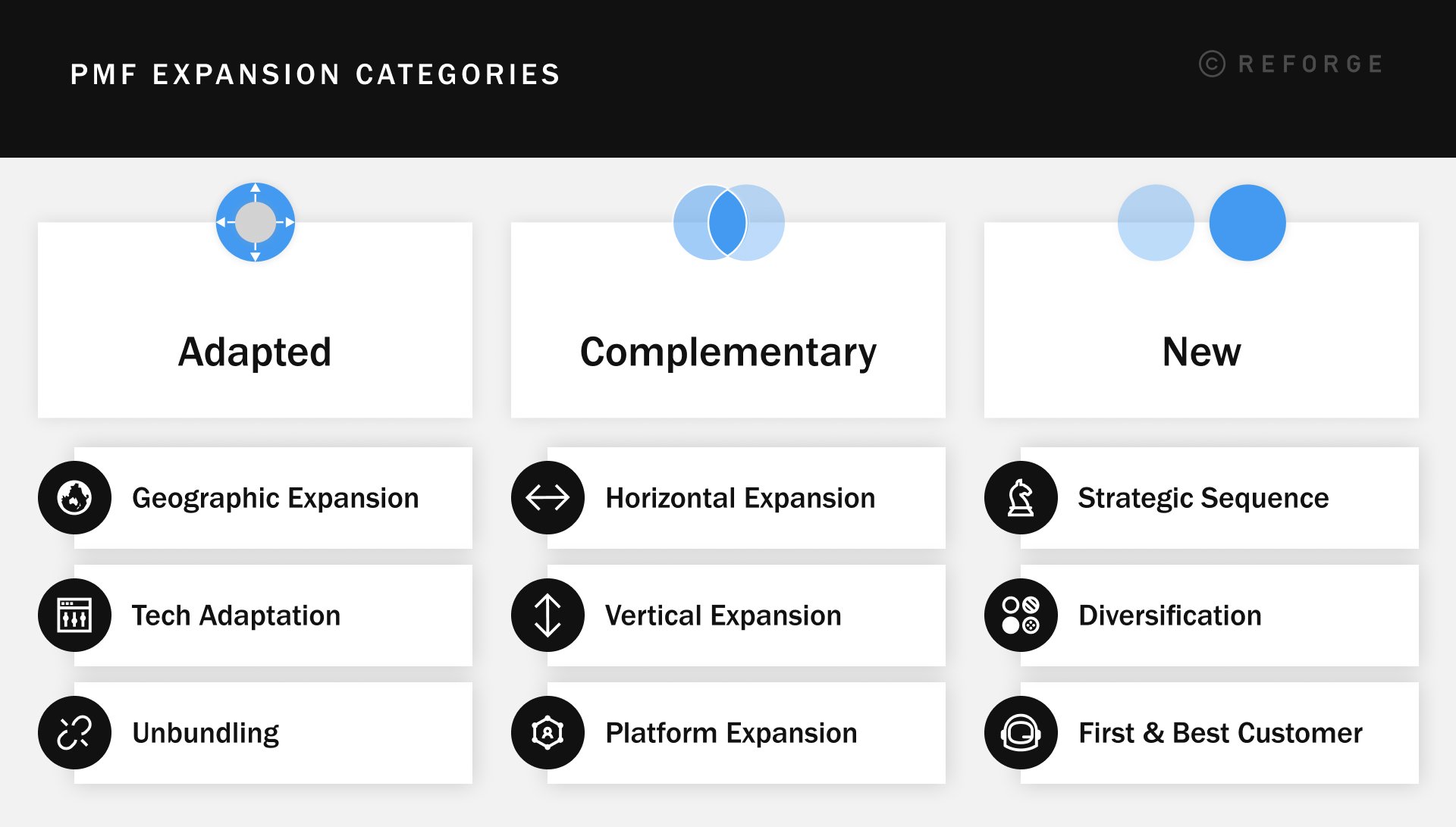

If successful, your team will eventually need to invest in Product Market Fit (PMF) Expansion opportunities. But leaders trip up when they assume that expansion requires international growth. In reality, there are three different categories of expansion investment.

Adapted expansion: Adapting the existing core use case to different audiences, geographies, etc

Complementary expansion: Finding complementary use cases with overlapping use use qualities

New expansion: Building for a net-new problem space

Ultimately, to convince yourself that international growth is the right PMF Expansion bet, you need to be able to compare it to other expansion bets. This is why proactively understanding the ROI is so critical. (Remember: proactivity breeds optionality!)

If you’re not explicit about how international expansion fits into your portfolio (and why), it will be impossible to understand if the investment is working across an agreed-upon time-horizon.

What are the Validation Gates for Continued Investment?

Because expansion efforts are inherently risky propositions, teams need to set up validation gates to make sure they’re operating off informed insights around progress. These gates function as markers to check on the strategy and make sure each hypothesis for what would be true in-market is true and, importantly, ROI positive. Align on expectations upfront about who will evaluate these and at what cadence.

For example, if your primary acquisition tool is a paid loop, you need to validate that return on ad spend, (ROAS) in market on new channels is ROI-positive (or you can see the path to it).

While evaluating candidate expansion markets at Credit Karma we did marketing tests to validate ROAS in both Canada and India. We ran ads that directed users to some light-weight content on credit scores with a call-to-action to join the waitlist. This initial validation fed into our expectations for CAC that informed how we ultimately prioritized entry into Canada and decided to not enter India.

As we expanded into Canada, we developed a full view of our quantitative growth model that justified investment. As we launched and gained traction, we regularly revisited performance against the original expectations to keep refining our model inputs for the core paid ad loops. In order over time, we focused on:

Validating CAC

Validating engagement rates of users

Introducing monetization features and validating user LTV and Payback Period expectations

Quarterly business reviews and the annual budgeting process was the chance to ensure the CEO and CFO were up to date on how our investments were performing and to facilitate incremental investments.

When these validation gates are clear, executives must be willing to make the long-term commitment to the investment. Without it, it’s harder to attract and retain the best talent to lead the efforts, goals won’t get met, the investment risk will then increase, and the loop gets negatively reinforced.

P.S. We go much deeper into identifying and evaluating new market expansion opportunities in our Product Strategy Program.

What is the minimum investment to enable successful execution?

Even if you’ve aligned on your portfolio and validation gates, it’s critical to have an explicit conversation about the actual investment. It’s easy to skip over this, assuming the leadership team is all on the same page if everyone understands the strategy.

This is short-sighted. You need to actually list out what you need for execution, not just strategy. This can include headcount, your talent strategy, local operational expertise, customer research, and more.

Four Cases of International Growth: Credit Karma, Gilt, Geniebook, and Glints

The “where, when, if” framework can help guide your business towards better decision making, no matter your stage. The framework guides a typically binary decision — yes or no — into a more robust growth strategy, allowing you to better evaluate the ROI of different opportunities and compare them to other means of expansion for your business model.

To explore how this framework is put into practice, we’ve collected four case studies from Credit Karma, Gilt, Geniebook, and Glints. These cases demonstrate how different companies have made the decision on where, when, and if to invest internationally — across both Adjacent User and Seed & Grow expansion models, including companies at different stages of their growth.

Putting it All Together

A good strategy is the starting point to setting up a team to be able to execute independently and effectively. Without it, you’ll run into the pitfall of constantly re-evaluating if you’ve invested too little, or too much.

I’ll leave you with some final tips:

Establish core hypotheses about the real mechanisms required for growth before you make a concerted investment.

Treat international expansion as one of many options for product market fit expansion, and evaluate it as one of those bets rather than a siloed team without the resources or accountability to succeed

Recognize that success in-market is a driver for continued investment. There is no “done.”